Categories

Archives

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |

Commentaries

APA August 2013 Special Market Commentary

By: admin / August 15th, 2013

Three Reasons Munis are a Buy Right Now

At APA, we believe municipal bonds are a strong buy right now based on historical observations, current market trends and relative value to the US Treasury.

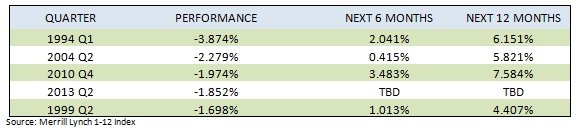

Periods of downturn are often followed by upturns in the market. The second quarter of 2013 was the fourth worst performing quarter in the last 20 years according to the Merrill Lynch 1-12 Municipal Index. Historically, these significant market downturns have been followed by periods of outperformance. The chart below lists the five worst quarters in the last 20 years, followed by the subsequent six month and twelve month returns.

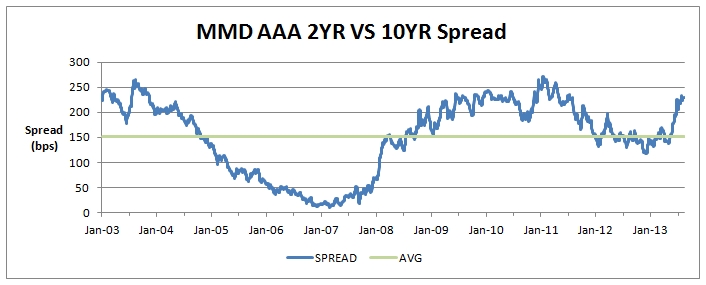

Spreads have widened far above historical averages. Additionally, the municipal yield curve has become significantly steeper in the last six months. As of August 13th, 2013 the spread between 2-year AAA municipals and the 10-year AAA municipals was 236 basis points versus 160 bps at the end of the first quarter 2013. The average over the last ten years has been approximately 150 basis points. Considering these current market conditions, coupled with the continued economic environment of low inflation, high unemployment and below average GDP growth, we believe the spreads will come back in closer to the historical averages.

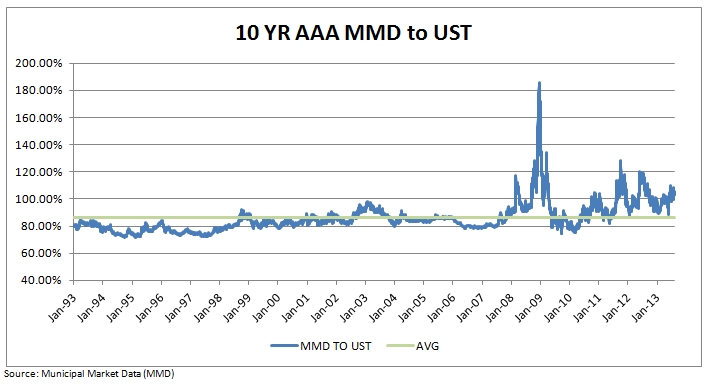

AAA municipal yields continue to look attractive compared to Treasuries. Over the last twenty years the ratio between AAA municipal yields and US Treasury yields has averaged 86%. In 2009, this ratio inversed dramatically when muni yields jumped up to over 186% of US Treasuries in December 2008. Since then municipals have remained consistently attractive on a relative basis. As of August 13th, 2013 the ratio stood at 103%. Considering the added tax advantages of municipal bonds, APA believes high quality municipal bonds are still a buy at these levels.

Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Asset Preservation Advisors, Inc. reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. This is not a recommendation to buy or sell a particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

APA is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill of training. More information about the advisor including its investment strategies and objectives can be obtained by visiting www.assetpreservationadvisors.com. A copy of APA’s disclosure statement (Part 2 of Form ADV) is available without charge upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact APA at 404-261-1333 if you would like to receive this information. APA-13-236

Connect With Us