Categories

Archives

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |||

| 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 12 | 13 | 14 | 15 | 16 | 17 | 18 |

| 19 | 20 | 21 | 22 | 23 | 24 | 25 |

| 26 | 27 | 28 | 29 | 30 | 31 | |

Commentaries

June Market Commentary

By: admin / June 27th, 2012

“See You in September”

A tepid victory by pro Euro Zone politicians in Greece provided little confidence that the Zone’s debt woes were nearing a solution. Much like last summer’s give and take between wealthier Zone members like Germany and France and their poorer neighbors, the PIIGS (Portugal, Italy, Ireland, Greece and Spain), last week’s elections have only magnified differences and increased investors’ flight to safety. The resulting steep declines in yields in U.S. Treasuries, German Bunds and Swiss Bank deposits underscore not just safe haven moves but also continued uncertainty as to whether a global solution to fiscal and economic storms is achievable this summer. In May, ahead of the Greek Elections, APA highlighted Neil Sedaka’s 60’s era tune “Breaking Up is Hard To Do.” This month, given a repeat of last summer’s volatility in yields and equity markets, we are reminded of another 60s hit “See you in September” whose lyrics offer some levity and direction to investors:

“… While you’re away, don’t forget to write…Bye-bye, so long, farewell…See you in September…See you when the summer’s through….”

If only it were that easy.

- A victory by the pro Euro Zone party in Greek Elections June 17th did little to soothe world financial markets. Uncertainty as to a comprehensive solution to Euro Zone debt woes persisted.

- Treasury and Muni Yields, along with global equity markets, reacted to the Greek vote with more of the same confusion and flight to safe havens similar to last summer’s market moves.

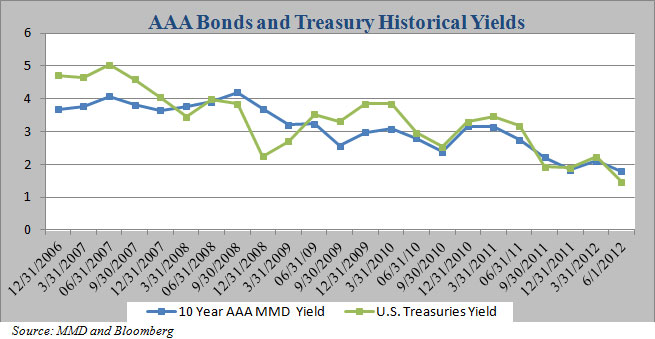

- For example, the benchmark 10-year note fell to a historic low of 1.47% on June 1st, down from 1.83% on May 9th and 2.01% in the Treasury auction of March 9th. The 10-year yield remained at these lows, having closed at 1.62% in the June 13th auction.

- Economic measures such as the May Jobs report on Friday June 8th, the Michigan Consumer Sentiment Report of Friday June 15th and a Manufacturing Index decline the same day indicated a return to the pull back scenario in the U.S. economic recovery seen in the summer of 2011.

- The weak economic reports pushed the stock market’s “Volatility Index” to 2012 highs, underscoring the perceived risk of another recession in the U.S. Analysts believe Europe to be in a recession.

- UBS reported that relative to other fixed income sectors, municipal total returns are outpacing Treasuries, Agencies and Mortgage-Backed securities on a year-to-year basis.

- The failed recall of Wisconsin Governor Scott Walker and local anti-union votes in two California cities could have a positive impact on Municipals as local governments address unfunded pension liabilities and retiree benefits.

Greeks Vote to Stay in Euro Zone; Winner Attempts to Form Government

Although the New Democracy Party, led by U.S. Educated Antonis Samaras, won a critical referendum on Euro Zone membership, Samaras must now piece together a governing coalition. And with only 30% of the vote, barely ahead of the Leftist party that vowed to refute Euro Zone austerity requirements, world markets reacted skeptically to the hope that a resolution was near to the Euro’s growing debt and funding crises. An overriding fear seems to be that Greek, Spanish and Italian bond auctions would be met with higher funding costs that were unsustainable and that a contagion would spread to other sovereign markets leading to a meltdown similar to the collapse and bankruptcy of Lehman Brothers in September 2008. The continued fear of contagion, more than Euro Zone politics, dominates global market sentiment and the resulting flight to the so-called safe havens in the U.S., German and Swiss Treasury vehicles.

Treasury Yields at Historic Lows; Inflows into Muni Funds Continue; Municipals as “Best in Show.”

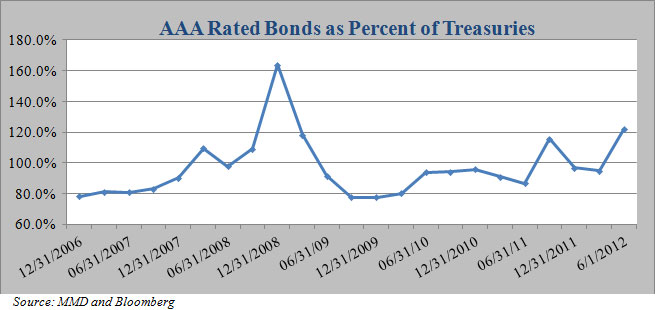

Continued uncertainty in the Euro Market as outlined above, apparent “risk-off trading” by nervous investors flocking to U.S. Treasuries and Municipals and continued inflows into municipal funds all contributed to fixed income yields falling to their lowest levels since 2009. Yields decreased slightly from last month with 2-year Treasuries at 0.28 on June 18th from 0.26 on May 9th, down from 0.29% on April 11th. The benchmark 10-year note yield decreased to a historic low of 1.47% on June 1st, down from 1.83% May 9th and 2.01% in the auction of March 9th. Triple A rated bond “spreads” to comparable Treasures hit one of their highest ratios since 2007 at 121.8%. The historic spread average is near 85%.

The U.S. Jobs report for May pushed the Stock Market “Volatility Index” to its highest level in nearly six months to a reading of 26.6. Though still below what market participants consider true panic levels, higher volatility prompted continuing inflows into municipal bond funds. Mutual funds, which are focused on city and state debt, brought in some $13 billion this year through May 30th, as reported by Lipper US Fund Flows data. This was the best annual inflow rate since the beginning of 2009 as the financial crisis unfolded and the seventh straight week of muni fund inflows.

Source: MMD and Bloomberg

UBS reported that when compared to other fixed income sectors, municipal total returns are outpacing Treasuries, Agencies and Mortgage-Backed securities on a year-to-year basis. Only Investment Grade Corporate Bonds and Taxable municipal bonds (as measured by a UBS index of Build America Bonds) had higher returns through April 2012.

“It’s The Economy Stupid”

During the 1992 U.S. Presidential Campaign Bill Clinton’s campaign strategist, James Carville, coined this phrase as the focal point for the Clinton campaign. The same theme may dominate the 2012 Presidential Campaign. The national economy showed renewed signs of another recession, with an uptick in the unemployment rate, fewer than expected new jobs, lower than expected GDP growth and declines in key manufacturing indexes. Home sales, in contrast, increased slightly as buyers took advantage of low home prices and historically low mortgage interest rates.

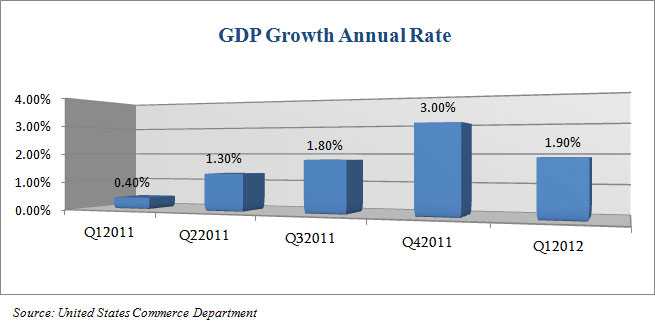

The national unemployment rate for the month of May 2012 increased slightly to 8.2%, up from the April 2012 rate of 8.1%. The Labor Department stated that employers added a net of only 69,000 new jobs in April, which was about half of the 150,000 new jobs expected by economists. This represented the first time in a ten month stretch in which the U.S. economy failed to add more than 100,000 jobs in a month. Moreover, the number of long-term unemployed, or those who have been out of work for more than 27 weeks, increased by 300,000 in May to 5.4 million. According to S&P, this represented 42.8% of the total number of unemployed. Also evidence of a sluggish economy is a GDP growth rate of only 1.9% annualized for 1Q 2012, a slower pace than the 3% reported in Q4 2011. Economists expect a sustained GDP rate of 3% to be reflective of a healthy economy.

Source: United States Commerce Department

Manufacturing, which accounts for approximately 12 percent of total economic output, once again grew, but at a slightly slower pace in May. This was the 34th consecutive month of manufacturing expansion. The Institute for Supply Management (ISM) reported that its index for factory outputs decreased slightly to 53.5% in May from 54.8% in April. The New Orders index increased for the 37th consecutive month to 60.1%, an increase of 1.9 percentage points from April. This was the highest level since April 2011.

After a boost in early 2012, the May Consumer Confidence reading continued a decline from the April 2012 reading. The Conference Board reported the Index stood at 64.9%, down from an April reading of 68.7%. The Consumer Confidence Survey is a leading indicator that tracks the national economy as consumer spending accounts for 70% of U.S. GDP. The “Present Situation Index”, which measures consumers’ feeling about their current economic situation, decreased to 45.9% in May from 51.2% in April and a February level of 71.6%. Underscoring the decline in consumers’ changing sentiment this year, the related “Future Expectations Index” decreased to 77.6% from 80.4% in April 2012 and 83% in March.

Wisconsin Governor Scott Walker Wins Recall Battle at Public Unions Expense; California voters endorse pension reforms

With many states facing increasing pension costs and other post-employment benefits such as health care, APA believes that the June 5th, 2012 Wisconsin Governor’s recall election pitting nationwide labor unions against the cost-cutting Republican Governor will have a positive effect on the municipal market. Governor Walker’s election win may set a precedent and encourage other states and fiscally conservative officials to curb collective bargaining rights, reduce other pension benefits and challenge labor unions in the wake of escalating unfunded pension costs.

The recall election brought to an end nearly 16 months of lawsuits, street protests and $65 million in campaign costs by various political groups. In the end, Wisconsin voters gave Republican Walker a resounding 7 point victory. The recall was staged in protest to Walker’s elimination in 2011 of many collective bargaining rights for public sector unions. The recall campaign collected 1 million signatures, drew out-of-state protestors to Madison and served as a proxy vote on Union dues collections. Walker’s recall win was seen by some as a victory for the Tea Party and other “less-is-more” government supporters and a significant blow to labor unions. Walker was the first U.S. Governor to thwart a recall following Governor Gray Davis’ loss in the 2003 California recall and North Dakota Governor Lynn Frazier losing his 1921 recall election.

In addition to the reform minded vote in Wisconsin, voters in two California cities strongly endorsed pension reform measures proposed by their elected officials. In San Diego voters approved moving non-public safety employees into 401-K plans and away from traditional defined benefit retirement plans and capped benefits for existing workers. And in San Jose, voters gave officials an overwhelming victory with a 70% approval to require public employees to make greater contributions to their pensions or accept reduced benefits on retirement. Taken with the Wisconsin vote, and in particular against traditional union strength in California, these elections underscore local voter resistance to increasing pension liabilities. Analysts used these votes to upgrade their opinions on Municipal finances expecting other local officials to take note of voter sympathies.

APA’s 2012 Strategic Direction

APA’s Investment Committee believes the best strategy currently is a Modified Barbell Strategy, which consists of high quality bonds, 50% of which we would recommend with a 1 to 5 year maturity and 50% in the 8 to 12 year area. APA’s duration target is 4 to 4.5 years. In order to help enhance our clients’ overall portfolio yield, APA will invest up to 20% of the total portfolio within the A-rated category. More specifically:

- For investors with a lower risk tolerance, APA recommends a Short-Term Strategy. With a lower duration and high credit quality, this strategy offers clients a defensive position against rising interest rates. We recommend this strategy to investors seeking protection of principal in a rising rate environment while looking for generally higher returns compared to traditional money market funds. APA will tailor this portfolio for each client based on their individual liquidity and tax needs.

- For new portfolios, or for investors seeking slightly higher yields at lower risk than longer duration bonds, APA recommends an Intermediate Strategy. With a slightly longer duration than APA’s Short-Term Strategy, we recommend bonds selected utilizing a modified “ladder” investment approach targeting bonds with 1 to 10 year maturities. We are also increasing our A rated bond holdings from 10% to 20% in this strategy.

Because APA does not see any significant near-term threat from inflation, the Investment Committee believes that current muted improvements in the economy will benefit investors buying along this curve. Our overall duration target is now in the 4 to 4.5 year range. The top five Municipal Bond sectors in our composite Intermediate Strategy portfolio includes Local General Obligation Bonds (GOs), Higher Education, “Other Revenue”, State GOs, and Utility Bonds.

- For investors with a higher risk tolerance seeking higher yields and attractive after tax returns, APA recommends our High Income Strategy. This strategy provides investors with higher current income while maintaining exemptions from federal income taxes. The bonds purchased in these portfolios have a slightly longer duration, lower credit ratings and longer maturities. The top five bonds in these portfolios typically are in the following sectors: hospitals, life care, other revenues, higher education, and local GOs.

- For all of the strategies detailed above, APA recommends investors allocate a portion of their portfolios to out-of-state bonds, even in high-tax states, in order to increase geographical diversification and help mitigate concentration risk. Currently, investors may take advantage of a slightly flatter, but still overall steep municipal yield curve, to help lessen the tax effect on out-of-state bonds by extending maturities a year or two out.

- Further, we believe that APA is well positioned to capture additional yield by investing in market sectors where credit spreads remain wider than historical averages. For example, we emphasize purchases of single A-rated issues, water & sewer bonds, highly rated hospital bonds, public power authorities and public school district debt in states offering an “intercept” program which can strategically bolster diversification and price stability.

Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Asset Preservation Advisors, Inc. reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

APA is a registered investment advisor. More information about the advisor including its investment strategies and objectives can be obtained by visiting www.assetpreservationadvisors.com. A copy of APA’s disclosure statement (Part 2 of Form ADV) is available without charge upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact APA at 404-261-1333 if you would like to receive this information. APA-12-124

Connect With Us