Categories

Archives

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |

Commentaries

September Market Commentary

By: admin / October 3rd, 2012

No sooner did we finish this month’s Commentary with reports of positive reaction in the bond and equity markets to the Fed and ECB’s September policy moves, than sentiment reversed and we now report more skepticism in World markets. When we reported earlier in the summer that the trend “See You in September” would prevail, little did we know the irony in the statement. Street riots followed the ECB’s significant backstop announcement in mid-September and U.S. equity markets initially rallied following the Fed’s “QE3” release only to reverse course and register several declines going into the final week of September.

We have seen the headline before – the “Crisis in Confidence” – and given recent market declines in the U.S. and street riots in Spain and Greece, one can reasonably conclude that more uncertainty may drive sentiment at least through the November elections in the U.S.

Perhaps it is appropriate to jump a generation from “See you In September” to Greens Day’s “Wake me up when September ends” with the fitting lyrics: “Summer has come to pass. The innocent can never last. Wake me up when September ends” (even more fitting if the lyrics read “when November ends”). However obvious, this whipsaw in both the equity and bond markets will continue until “certainty” returns to the Euro Zone and U.S. Any plan is better than no plan. One hopes the upcoming Presidential debates will surface tangible ideas that world markets can digest.

- Joint moves by the European Central Bank (ECB) and the Federal Reserve to pump liquidity into sagging economies in the Euro Zone and the U.S. seemed to work as the Euro and U.S. equity markets surged.

- Although widely anticipated as “QE3”, the Fed’s announcement to purchase up to $40 billion a month in mortgage-backed securities appeared to take direct aim at housing as a path to greater economic growth. Home builders’ stocks jumped on the news.

- Municipal Bonds’ tax exemption once again was targeted by budget negotiators as the White House and Congress addressed growing federal deficits.

- U.S. Treasury rates ended a summer roller coaster by advancing strongly on fears of inflationary moves by government bodies.

- Tax-exempt municipal bonds continue to compare favorably in price to corporate debt.

ECB’s Bond Buying Program

The European Central Back (ECB) unveiled its most recent economic blueprint aimed at struggling economies in the south, pledging to purchase unlimited amounts of government bonds of Spain, Italy and others whose cost of borrowing soared over the summer. The ECB’s plan, called Outright Monetary Transactions or OMT, will have the ECB purchasing bonds in an attempt to balance bond prices and decrease borrowing costs that were deemed unsustainable for the struggling economies. This follows the ECB’s earlier limited bond-purchasing program, which was considered not large enough to have any real impact on borrowing costs. The support came with stipulations: Any country requesting ECB aid must first seek emergency funding from the bailout funds supported by the 17 countries using the euro. They also must submit their economic policies to the International Monetary Fund for scrutiny. This is expected to place pressure on those economies with heavy debt loads and refinancing needs such as Spain and Italy. Some market observers warned that while the ECB’s plan provides short-term relief for select European countries, it does not address the underlying economic weaknesses that exist across the region. Investors endorsed the plan as borrowing costs declined in both Spain and Italy’s auctions.

Federal Reserve Announces QE3

On September 13th, as expected and reported in APA’s August 2012 Commentary, the Federal Reserve officially announced another quantitative easing, or QE3. In a move that was in response to anemic economic reports and as an attempt to stimulate the housing and stock markets, the Federal Open Market Committee agreed to purchase up to $40 billion a month in mortgage-backed securities. With the Fed already purchasing $45 billion in long-term bonds each month via “Operation Twist”, there will now be nearly $85 million in bonds purchased monthly by the Fed. The Fed’s monetary policy committee hinted at further action if persistent high unemployment continues and if the overall economic indicators prove sluggish. As Fed Chairman Ben Bernanke stated in his post meeting press conference, “We’re not promising a cure to all these ills. But what we can do is provide some support.”

The Fed also announced it expects to keep short-term interest rates near zero well into 2015, a shift from only a month ago when the Fed stated it would be keeping the benchmark Fed funds rate near zero “at least through late 2014.” Mortgage rates continued at all time lows through the summer.

|

2012 Mortgage Rates Snapshot |

||

|

15-year Fixed |

|

|

|

September 2012 |

Sept. 2011 |

Sept. 2008 |

|

2.85% |

3.32% |

5.64% |

|

|

|

|

|

30-year Fixed |

|

|

|

September 2012 |

Sept. 2011 |

Sept. 2008 |

|

3.55% |

4.09% |

6.04% |

|

Source: USA Today |

|

|

Bernanke also warned of consequences from the so-called “Fiscal Cliff”, with the potential for $600 billion of government spending reductions and coincident tax increases scheduled that are to take effect in January 2013 unless Congress agrees on a new Federal budget. While market participants had mixed views on the Fed’s plan, U.S. stocks saw gains following the announcement. The S&P Index ended the day following the Fed meeting 1.6% higher, with the Dow adding 207 points. The NASDAQ rose 1.3%.

Legislative Watch: Elimination Of Municipal Tax Exemption?

In an attempt to balance the Federal Budget, the President and Congress have rejoined the discussion on eliminating the tax exemption on municipal bonds. While neither the Democrats nor the Republicans addressed the municipal tax exempt issue in their respective presidential party platforms, there has been some discussion of the potential elimination of this once sacrosanct ability for state and local governments to issue bonds exempt from Federal taxes. This is not the first time the debate has occurred. The Federal government threatened to severely restrict the use of tax exempt bonds through the Tax Reform Act of 1986. While the Federal government was successful in creating a taxable market by limiting certain types of issues that could be considered tax exempt (such as private activity bonds), it was not successful in restricting traditional municipal borrowers from using tax exempt bonds. The tax exempt issue came up once again a little more than a year ago in President Obama’s “Jobs Act of 2011.” In that plan, the President recommended capping the exemption at 28% for high income earners.

While the Obama plan never saw the light of day, negotiators continue to raise the issue of reducing tax benefits in order to close a growing budget deficit. While this is the tax exemption’s most serious threat in years, APA believes that the exemption for municipals will remain for the following reasons:

- Any elimination may pose constitutional issues regarding States’ rights and could result in an extended legal battle.

- Revenues generated from the elimination of the tax exemption are estimated to reduce the deficit by only 2-6%, a drop in the bucket to the $1 trillion (and growing) budget deficits.

- State and local governments have threatened to come out in full force against any plan that would prevent them from issuing tax exempt debt with lower costs at a time when they are facing budget challenges from the “great recession”. The Bank of Montreal estimates that 75% of U.S. infrastructure projects are funded through the use of tax-exempt bonds.

Treasury Yields Bounce Back

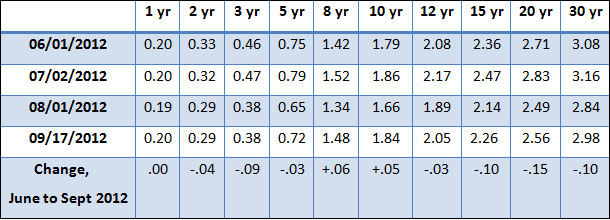

With Euro Zone pressures easing and the Fed’s “new QE” announcement, Treasury Yields entered the Fall in a rising trend. The increase was somewhat surprising following the summer months where the 10-year yield fell in mid-July to a 40-year low. In addition, tax-exempt municipal bonds continue to be at their cheapest when compared to corporate debt. According to U.S. Treasury Department data examined by APA, Treasury yields increased slightly from last month with 2-year Treasuries at 0.25% on September 18 from 0.24% on August 8th. The benchmark 10-year note yield has seen a marked increase to a 1.85% yield on September 18th. This was a significant increase from the July 25th intraday trade at a historic low of 1.43%. Triple-A rated bond spreads to comparable Treasures hit one of their highest ratios since 2007 at 104% on September 17th, 2012. The historic spread average is near 85%.

The yield on the 10 year AAA muni also showed increases through the first part of the month. The September 17th yield of 1.84% was 5 bps above the June 1st yield of 1.79%.

AAA Municipal Yield Curve

|

APA’s Strategic Direction

APA’s Investment Committee believes the best strategy currently is a so-called “modified barbell strategy”, consisting of high quality bonds, 50% of which we would recommend with a 1 to 5 year maturity and 50% in the 8 to 12 year range. APA’s overall duration target is 4 to 4.5 years. In order to help enhance clients’ portfolio yield, APA will invest up to 20% of the total portfolio within the A-rated category. More specifically:

- For investors with a lower risk tolerance, APA recommends a Short-Term Strategy. We feel that with a lower duration and high credit quality, this strategy offers clients a defensive position against rising interest rates. We recommend this strategy to investors seeking protection of principal in a rising rate environment while looking for generally higher returns compared to traditional money market funds. APA will tailor this portfolio for each client based on their individual liquidity and tax needs.

- For new portfolios, or for investors seeking slightly higher yields at lower risk than longer duration bonds, APA recommends an Intermediate Strategy. With a slightly longer duration than APA’s Short-Term Strategy, we recommend bonds selected utilizing a modified “barbell” investment approach targeting those bonds with 1 to 12 year maturities. We are also increasing our A rated bond holdings from 10% to 20% in this strategy.

Because APA does not see any significant near-term threat from inflation, the Investment Committee believes that current muted improvements in the economy could benefit investors buying along this curve. As stated, our overall duration target is now in the 4 to 4.5 year range. The top five Municipal Bond sectors in our composite Intermediate Strategy portfolio includes Local General Obligation Bonds (GOs), Higher Education, “Other Revenue”, State GOs, and Utility Bonds.

- For investors with a higher risk tolerance seeking higher yields and attractive after tax returns, APA recommends our High Income Strategy. This strategy provides investors with higher current income while maintaining exemption from federal income taxes. The bonds purchased in these portfolios have a slightly longer duration, lower credit ratings and longer maturities. The top five bonds in these portfolios typically are in the following sectors: hospitals and health care, other revenues, higher education, and local GOs.

- For all of the strategies detailed above, APA recommends investors allocate a portion of their portfolios to out-of-state bonds, even in high-tax states, in order to increase geographical diversification and help mitigate concentration risk. Currently, investors may take advantage of a comparatively flatter, but still overall steep municipal yield curve, to lessen the tax effect on out-of-state bonds by extending maturities a year or two out.

- Further, we believe that APA is well positioned to capture additional yield by investing in market sectors where credit spreads remain wider than historical averages. For example, we emphasize purchases of single A-rated issues, water & sewer bonds, highly rated hospital bonds, public power authorities and public school district debt in states offering an “intercept” program which can strategically bolster diversification and price stability.

Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Asset Preservation Advisors, Inc. reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

APA is a registered investment advisor. More information about the advisor including its investment strategies and objectives can be obtained by visiting www.assetpreservationadvisors.com. A copy of APA’s disclosure statement (Part 2 of Form ADV) is available without charge upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact APA at 404-261-1333 if you would like to receive this information. APA-12-210

Connect With Us