Categories

Archives

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |||

| 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 12 | 13 | 14 | 15 | 16 | 17 | 18 |

| 19 | 20 | 21 | 22 | 23 | 24 | 25 |

| 26 | 27 | 28 | 29 | 30 | 31 | |

Commentaries

APA February 2013 Commentary

By: niche / February 20th, 2013

The late Senator Everett Dirksen was quoted during contentious Appropriations Hearings as saying: “A Billion here, a billion there and pretty soon you’re talking about real money.” Although the statement referred to Congressional spending patterns, it is equally applicable to today’s unfolding taxing pattern. As we detail in the February Commentary, the growing debt and deficit debates are bringing billions – now trillions – in new taxes to a profligate America. As the debate escalates over sequestration and the Federal debt ceiling over the next few weeks, it has become apparent that higher taxes will be front and center in the negotiations. Senator Dirksen was also quoted as saying: “We are becoming so accustomed to millions and billions of dollars that “thousands” has almost passed out of the dictionary.” If only things were so simple. In today’s economy and with Congress and the White House staking out higher “enhanced revenue” positions, the prospect of “millions” in new taxes will be replaced in the political dictionary with billions and perhaps even trillions in new taxes over the next decade. Dirksen must be smiling down on the current Congressional budget debates.

- The American Taxpayer Relief Act passed by Congress ushered in the largest Federal tax increase in decades.

- States and localities are also beginning to institute new taxes as a way to offset rising expenses, especially those related to pension and healthcare benefits.

- In contrast though, a group of Republican Governors are pushing for lower taxes with some actually calling for elimination of their state income tax.

- A recent Bank of America/Merrill Lynch report highlighted Munis appeal, given the increase in marginal tax rates along with the phase out and elimination of certain exemptions and deductions.

- The national economy showed mixed signs of recovery, with the unemployment rate holding steady despite negative GDP growth in the 4th quarter of 2012.

- APA believes there are still opportunities to purchase municipal bonds with positive underlying credit fundamentals without giving up substantial yield.

Tax Here, Tax There; Taxes Everywhere The American Taxpayer Relief Act passed by Congress ushered in the largest Federal tax increase in decades. In total, the bill included $600 billion in new tax revenues to be collected over ten years, about one-fifth of which would have been raised through previous agreements had the recent legislation not been passed. But the Federal tax increases are not the only burden to the taxpayer. States and localities are also beginning to institute new taxes as a way to offset rising expenses, especially those related to pension and healthcare benefits. Some examples include:

- California’s Proposition 30, which is projected to raise $6 billion annually for education and State budget deficits by increasing the sales tax by a quarter-cent for four years and raising income taxes on the wealthy by some 3% over seven years. APA notes that the tax increase helped California turn its budget around and was a key reason cited by Standard & Poor’s in its upgrade of the State’s General Obligation rating to A from A- last month.

- California voters also passed Proposition 39, eliminating a loophole that allowed multistate businesses to pay fewer California taxes. The new law is expected to bring in an additional $1 billion a year in revenue for the state.

- New Jersey’s “Exit Tax.” New Jersey’s exit tax is an estimated tax payment applied to the sale of an individual’s home if the individual plans to leave the state after selling the home. The amount of the exit tax is a standard state tax rate of 8.97% on the profit a resident makes from the sale. The tax only applies to residential homeowners who sell and leave the state. Residents who sell their homes but remain in the state are not subject to the exit tax as they will pay tax on any home sale profits as part of their state income tax levy the year following the sale.

- The Governor of Minnesota, in his State of the State address, called for an increase in sales taxes on certain items, an income tax increase on the state’s wealthiest residents and higher cigarette taxes. All of these new Minnesota taxes are expected to increase revenue by $2.1 billion.

- Finally, Illinois increased its personal income tax in 2011 from 3% to 5% – a 66% increase.

In contrast though, a group of Republican Governors are pushing for lower taxes with some actually calling for elimination of their state income tax. There are currently nine states that do not have a state income tax or a very limited personal income tax. They are: Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming, Tennessee and New Hampshire. The Wall Street Journal reports that additional states reviewing their state income tax policy for potential changes include:

- Oklahoma and Kansas, which have reduced their income tax rates in the past two years. Their Republican Governors are pushing their legislatures to eliminate the tax altogether.

- North Carolina’s Governor has pledged to reduce taxes overall and is focusing on the state’s income tax elimination as a measure to attract business and compete with other southeastern states like Florida and Tennessee.

- The Governor of Indiana is calling for a 10% reduction in that state’s income tax.

- Other states like New Mexico and Arkansas are looking to reduce their income and/or business taxes as well. In Ohio, the Governor is proposing to utilize the revenues from oil and natural gas drilling as a way to reduce the state’s income tax burden.

- Nebraska’s Governor has asked the legislature to eliminate that state’s income tax and replace it with a broader sales tax while Louisiana Governor Jindal, a potential Presidential contender, has proposed a reduction in his state’s top tax rate to 0% and replace it with an increase in sales taxes.

Muni Tax-Exemption Survives; Higher Marginal Tax Rates Bode Well for Municipal Bonds

The Municipal Bonds’ Tax Exemption status did survive the recent tax legislation signed by President Obama in January. Many municipal market participants believe the tax-exemption will remain in place, at least in the near term. Any cap or elimination in the exemption would likely come with comprehensive tax reform legislation, which APA believes is not likely to emerge in this Congress.

The major change resulting from the recent tax legislation is the increase in marginal tax rates. A recent Bank of America/Merrill Lynch report highlighted Munis appeal, given the increase in marginal tax rates along with the phase out and elimination of certain exemptions and deductions. BofA/Merrill reports that the marginal tax rate for high earners (those with incomes of $400,000/single and $450,000 for couples) increased to 39.6%. Certain deductions and exemptions were also phased-out in the legislation, bringing certain lower earning taxpayers ($200,000 single and $250,000 for couples) effective rates that can rise as high as 38%. In all, combined tax increases could place total marginal rates at the Federal level as high as 43.4% according to BofA/Merrill.

It’s Still the Economy

As reported in the June 2012 Commentary, Bill Clinton’s campaign strategist, James Carville, coined the phrase “It’s the Economy Stupid” as the focal point for Clinton’s 1992 Presidential campaign. That same 20-year old theme continued to resonate in the United States political landscape throughout 2012 and into early 2013. The national economy showed mixed signs of recovery, with the unemployment rate holding steady despite negative GDP growth in the 4th quarter of 2012. Home sales, in contrast, increased markedly in 2012 as buyers continued to take advantage of lower home prices and historically low mortgage rates.

The national unemployment rate for the month of January basically held steady at 7.9%, near levels where it has been since September 2012. The Labor Department stated that employers added a net of 157,000 new jobs in January and that the number of long-term unemployed, those who have been out of work for more than 27 weeks, also held steady at 4.7 million. According to the Labor Department, this represented 38% of the total number of unemployed. Initial Jobless Claims for the week ending February 2nd decreased to 366,000 from the previous week’s number of 371,000. More evidence of a sluggish recovery was a GDP growth rate of -.01% annualized for 4Q 2012, a substantial decline from the 3.1% reported in Q3 2012. The Department of Commerce stated the downturn in real GDP in the fourth quarter was the result of declines in private inventory investment, slumping exports and a decline in state and local government spending. Economists typically expect a sustained GDP rate of 3% to be reflective of a healthy economy.

Manufacturing, which accounts for approximately 12 percent of total economic output, once again grew for a second consecutive month in January. The Institute for Supply Management (ISM) reported that its index for factory outputs increased markedly to 53.1% in January from 50.2% in December. The so-called New Orders index increased to 53.3%, an increase of 3.6 percentage points from December.

After a boost in early 2012 the Consumer Confidence reading indicated a decline in January 2013 from the December 2012 reading. The Conference Board reported the Index stood at 58.6% in January 2013, down from 66.7% in December 2012 and down from the April 2012 reading of 68.7%. The Consumer Confidence Survey is a leading indicator that tracks the national economy as consumer spending accounts for 70% of U.S. GDP. The “Present Situation Index”, which measures consumers’ feeling about their current economic situation, decreased to 57.3% in January 2013 from 64.6% in December 2012.

Underscoring the decline in consumers’ changing sentiment this year, the related “Future Expectations Index” decreased markedly to 59.5% in January 2013 from 68.1% in December 2012 and significantly below a reading of 80.4% in April 2012.

Opportunities still exist in the Municipal Markets

APA believes there are still opportunities to purchase municipal bonds with positive underlying credit fundamentals without giving up substantial yield. APA’s duration target of 4.00-4.50 years utilizes a barbell strategy with equal weight in the 1-3 year range and 9-12 year range. Underlying credit factors are analyzed with all purchases, allowing APA the opportunity to add value in low AA and A rated credits. This barbell structure takes advantage of a steep municipal yield curve, while maintaining liquidity at the short-end. Adding a percentage of “callable” bonds beyond 10 years adds a defensive element that 10 year “non-call” bonds do not have. Our focus, in searching for opportunities for example, might include premium coupon, callable, or “kicker” bonds that are priced in the secondary market to a shorter call. In the case where they are not called, these bonds will “kick” to a higher yield to the final maturity date. Not only can this provide protection from rising interest rates, but APA believes it is a method for achieving incremental yield compared to non-call bullet maturities in both the year of the call as well as the final maturity date.

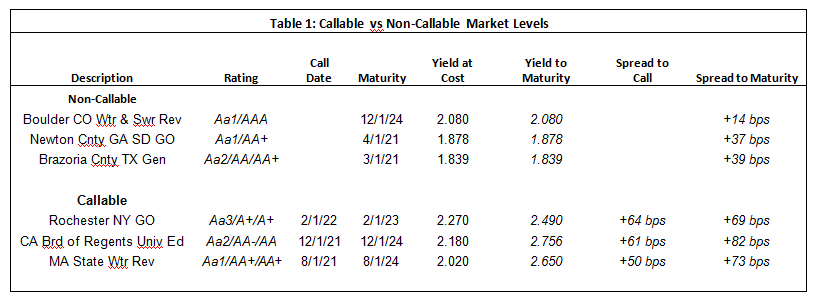

For example, APA’s examination of active market levels shows that three non-callable bonds chosen shows a +14 bps spread, a +37 bps spread, and a +39 bps spread. Examining callable bonds with similar ratings with similar maturities shows a +69 bps spread, a +82 bps spread, and a +73 bps spread (see Table 1: Callable vs. non-callable market levels).

Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Asset Preservation Advisors, Inc. reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

APA is a registered investment advisor. More information about the advisor including its investment strategies and objectives can be obtained by visiting www.assetpreservationadvisors.com. A copy of APA’s disclosure statement (Part 2 of Form ADV) is available without charge upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact APA at 404-261-1333 if you would like to receive this information. APA-13-58

Connect With Us