Categories

Archives

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |||

| 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 12 | 13 | 14 | 15 | 16 | 17 | 18 |

| 19 | 20 | 21 | 22 | 23 | 24 | 25 |

| 26 | 27 | 28 | 29 | 30 | 31 | |

Commentaries

APA March 2013 Commentary

By: niche / March 21st, 2013

CREDIT MARKETS

Sequestration: Limited Impact on Muni Market; Long Term Impact on Key States Possible

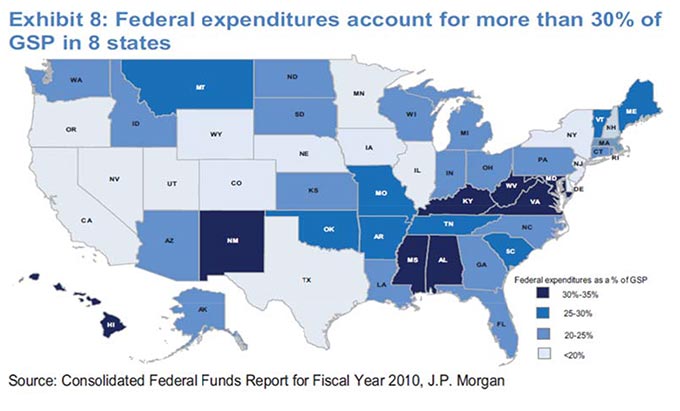

With the recent “Sequestration trigger” there appeared to be little immediate impact on the municipal credit markets. However, APA believes there could be some longer lasting effects on the economy and financial operations in certain states. The Sequestrations, which went into effect March 1st as a result of the Budget Control Act of 2011, mandated $1.2 trillion in Federal spending reductions over a ten year period. In December of 2012, APA reported the potential impact the reductions could have on certain states based on the number of Defense related military personnel employed in the states along with job losses in the healthcare sector. JP Morgan rece ntly released a report affirming APA’s earlier views stating that the states that could be impacted are those in which federal expenditures account for more than 30% of State “gross product.” States falling into this key category include Kentucky, West Virginia, Virginia, Mississippi, and Alabama.

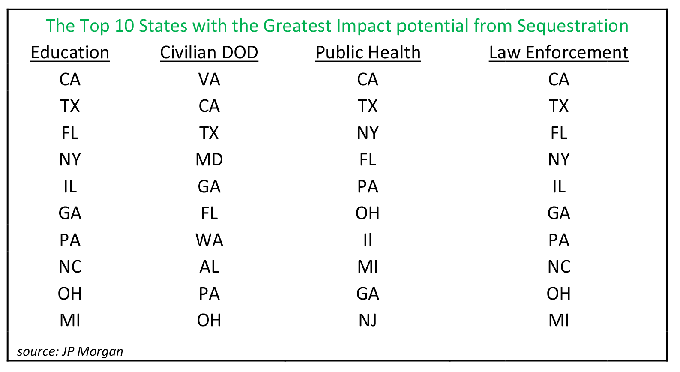

From large Federal government employers, such as the military, along with state government provided services such as education, public health, and law enforcement, the Sequester’s effect goes deep. According to data provided by JP Morgan, a state like Califor nia, in which APA activity remains highly selective, could be the most affected by sequestration. Three of the most affected areas, Education, Public Health and Law Enforcement, are significant California economic e ngines with Defense Department employment second to these sectors. APA currently has three of the most affected states (California, Florida, and Pennsylvania) on an internal “Watchlist,” meaning we are highly selective w hen investing in these states. This “Watchlist” is reviewed on a quarterly basis.

While APA expects Congress and the Obama Administration to continue to look for alternatives to sequestration as a way of reducing the Federal Government’s deficit and to mitigate the effects on a struggling national economy, for now the cuts are law.

Trustee for Detroit; Michigan Governor’s Action

On March 1st, Michigan Governor Rick Snyder declared a fiscal emergency for the city of Detroit, bringing the city closer to becoming the largest U.S. Municipality and the sixth in Michigan to have state government in control of its finances. According to the Associated Press, Detroit faces a $327 million budget deficit and has more than $14 billion inlong-termdebt along with persistent a nd long standing current cash flow issues. The City, once one of the largest in the U.S., lost half of its population in the past 50 years, leading to declining revenues while expenses continued to increase. In 2012, Michigan declared a financial emergency for Detroit, which then entered into an agreement to collect more taxes, renegotiate its debt obligations and undergo a substantial financial review. The review, which came out in February 2013, sho wed that Detroit was in w orse financial shape than originally believed. The review cleared the way for the Governor to recommend appointing an emergency financial manager. Gov. Snyder believes that an Emergency Manager for Detroit provides the best chance for the city to avoid bankruptcy. The Detroit City Council has since v oted to appeal the Governor’s decision.

Municipal Tax Exemption: An Update

State, city and other key market participants re main concerned with the continued threat of some form of reduction in the tax exemption on Municipal Bonds as evidenced by the Obama Administration’s proposed 28% cap on tax deductions and income exclusions. Recently, the National Association of Counties, the National League of Cities and the U.S. Conference of Mayors petitioned Congress to block any proposal related to the Municipal exemption issue. They argued in a report entitled “Protecting Bonds to Save Infrastructure and Jobs” that municipal bonds finance essential public projects and that any changes to thetax-exemptionwould result in an increase in the cost of borrowing and could lead to layoffs on shelved infrastructure projects. The report further stated that if applied retroactively, the 28% cap on tax exemptions could result in $173 billion of incremental interest expense for state and local governments over a ten year period.

In a related event, The New York Times reported on March 4th, 2013 that certain municipal bonds provided a way for businesses to benefit from the tax exemption forso-calledprivate development projects, which in the Times view amounted to a corporate “subsidy.” The article went on to list so me of these projects: a winery in North Carolina, a golf resort in Puerto Rico and a Corvette museum in Kentucky along with Barclays Bank Center in Brooklyn, the New York Corporate offices of Goldman Sachs and Bank of America. The dollar am ount reported for these bonds was m ore than $65 billion when issued on behalf of the corporations since 2003. While APA does not dispute that the projects were financed withtax-exempt bonds, we believe that based on the dollar amounts, that the specific project costs are small when compared to the overall $3.7 trillion value of the municipal market. The $65 billion in projects financed is less than 1% of total outstanding municipal debt and would have little impact on investors should the exemption be curtailed.

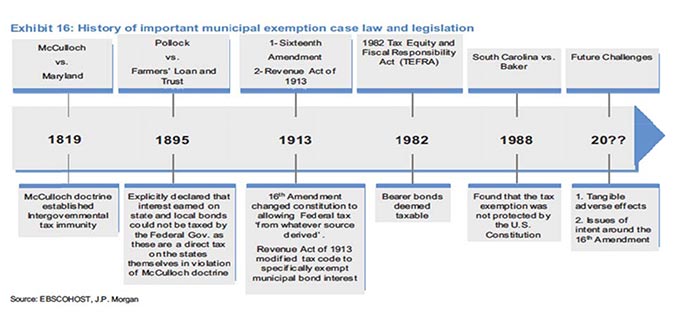

The Challenges to Tax Exemption for Municipals; A Timeline

JP Morgan also reported that this is not the first effort to challenge the tax exemption for municipals. They state (Exhibit 16 below) that municipal bonds’ taxation issues have been debated for more than 100 years. The challenges to Muni’s tax exemption often surface in times of increasing federal debt and deficits and were defeated through effective communication by State and local governments to their respective Congressio nal offices. APA believes that State and local leaders must continue to be diligent in their efforts to avoid losing their tax exemption, especially during times of debate over Federal spending and deficits and in light of popular sentiment that Municipal Bonds are a favored investment only for the wealthy. In fact, the Bonds are traditionally popular investments for retirees and middle class incomes saving for various expenses.

“America Fast Forward Plan”

President Obama has proposed a new type ofdirect-paymuni bond to help finance m uch needed U.S. infrastructure improvements. The America Fast Forward Plan (AFF) would build upon the recently expired Build America Bond (BAB) program but would includeprivate-activitybonds and reduce certain limitations on how the bonds could be utilized. BAB’s, which were created in 2009 but could not be issued after 2010, could only be used for government purposes and for capital expenditures. BAB’s provided a 35% subsidy to issuers for the interest costs related to the projects from Federal taxes. The AFF proposal would offer similar subsidy levels, but the White House did not specify a subsidy level for the program. However, it is unlikely the program will see legislative support until Congress debates a comprehensive deficit reduction plan along with comprehensive tax reform legislation.

Illinois Settles with Securities and Exchange Commission

In a developing story, for only the second time in history, the State of Illinois and the Securities and Exchange Commission (SEC) reached a settlement over the important issue of disclosure of pension funding shortfalls by t he State. The State of Illin ois failed to adequately disclose to investors the various risks of its underfunded pension systems. Follow ing a similar agreement between the SEC and the State of New Jersey in 2010, the issue again brought to light the significance of adequate disclosure of State pension obligations when issuing M unicipal Bonds. The action was part of a broader plan by the SEC to bring greater transparency as well as accountability to the municipal market. APA will follow this important State/Federal litigation in our upcoming Commentaries.

TRADING MARKETS

Little Impact Seen from Sequestration in Trading Markets

Despite various credit issues and related headlines over the past few weeks, municipal market trading was largely conducted unfazed. For eight straight weeks $324 million was injected intomuni-bondfunds and ETF’s for the period ending March 1, according to Lipper data. Investor interest waned however in the week ending March 8th, with $97 million flowing out fro m these funds. The month of March is typically a weak month for Muni Bonds as investors tend to sell for tax reasons. APA’s experience is issuers have had more difficulty placing new debt as there is less bond maturity in March and less demand for new issues due to tax selling.

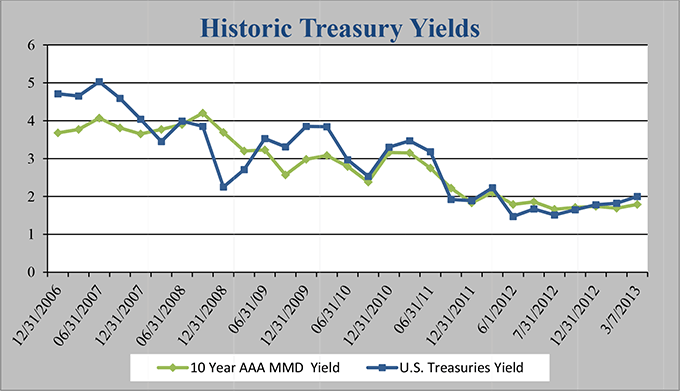

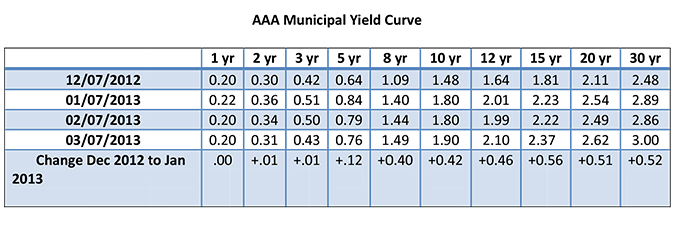

Treasury yields have increased slightly since year end 2012 with2-yearTreasuries at 0.25% on March 7 from 0.10% on December 5 and from 0.11% on November 3. The benchmark10-yearnote yield has seen recent increases, yet remains near historic lows as evidenced by the 2.00 % level on March 7 from a 1.78% yield on December 31. TripleA-ratedmuni bond “spreads” to comparable Treasures hit one of their highest ratios since 2007 at 121% on June 1, 2012. Current spreads are 89.5% as of March 7, 2013, with the historic spread average at 85%. A ratio over 100 indicates that Munis are less expensive relative to comparable Treasuries.

The yield on 10 year AAA Muni’s also showed increases over the past few months. A M arch 7, 2013 yield of 1.90% was 26 basis points above the December 7, 2012 yield of 1.64%.

GLOBAL OVERVIEW

Italy’s Credit Rating Lowered follo wing Mixed Election Results

On March 8, Fitch reduced Italy’s credit rating one notch to BBB+/negative outlook as the result of an inconclusive federal election. In its report, Fitch stated “The increased political uncertainty and non-conducive backdrop for further structural reform measures constitute a f urther adverse shock to the real economy amidst the deep recession.” Fitch also cited risks of “…sustained deterioration in fiscal funding conditions with adverse implications for financial conditions for the private sector and public debt dynamics.” Outgoing Prime Minister Mario Monti, who during the European debt crisis helped stem runaway growth in Italy’s Federal deficits and pushed through refor ms aimed at tightening the country’s current financial operations, lost are-electionin February to acenter-rightparty. As a result of the downgrade and an uncertain election outcome, Bloomberg News reported Italian bond futures fell 0.3% to a level of 108.84.

Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Asset Preservation Advisors, Inc. reserves the right to modify its current investm ent strategies and techniques based on changing market dynamics or client needs. This is not a recommendation to buy or sell a particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we m ake in the future will be profitable or will equal the investment performance of the securities discussed herein.

APA is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill of training. More information about the advisor including its investment strategies and objectives can be obtained by visiting www.assetpreservationadvisors.com. A copy of APA’s disclosure statement (Part 2 of Form ADV) is available without charge upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact APA at404-261-1333if you would like to receive this inform ation.APA-13-74

Connect With Us