Categories

Archives

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |

Commentaries

APA April 2013 Commentary

By: admin / April 18th, 2013

Stockton Granted Court Ordered Bankruptcy Protection

A California Judge has granted permission to the City of Stockton, the largest city to file for bankruptcy in recent years, to remain under court ordered bankruptcy protection after finding that creditors did not negotiate in good faith with the City. In June 2012, the City of Stockton voted to adopt a spending plan for operating under bankruptcy protection. Creditors, which included Assured Guaranty Corporation, argued in court that Stockton should not qualify for bankruptcy protection given that Stockton’s elected leaders did not negotiate a possible settlement in good faith and that the city was not insolvent. The U.S. bankruptcy Judge ruled that the creditors “absented themselves from all further discussion” with Stockton before it filed for bankruptcy. The Judge went on to say “negotiation is by definition a two-way street” and that “you cannot negotiate with a stone wall.”

Without the court-ordered bankruptcy protection, creditors would have been free to sue the City in state court, making it easier to force the City to sell assets, reduce services or increase revenues to repay its debt. With bankruptcy protection, the City is protected from the aforementioned actions and may choose which bills to pay. One recent development is that the City of Stockton is contemplating increasing its sales tax rate to 8.75% from 8.25% in an attempt to pay for additional police officers. Bloomberg Brief reported that in an attempt to stay solvent and pay its bills the City reduced the police force by 25% in 2011, resulting in a 25% increase in violent crime. The revenue from the increased sales tax would be held in a restricted account and would not be available to creditors.

Detroit Assigned an Emergency Manager

On March 1st, Michigan Governor Rick Snyder declared a fiscal emergency for the city of Detroit, bringing the city closer to becoming the largest U.S. Municipality and the sixth in Michigan to have state government in control of its finances. Gov. Snyder believes that an Emergency Manager for Detroit provides the best chance for the City to avoid filing for bankruptcy. On March 14th, the Governor named Keyvn Orr, a bankruptcy expert who represented Chrysler during its successful restructuring, to oversee what Orr said is the “Olympics of restructuring.” Detroit is now the largest U.S. city to have its finances placed under state control. Under Michigan law, emergency managers have the power to develop financial plans, renegotiate labor contracts, revise and approve budgets to keep spending in line, sell off city assets and suspend elected officials salaries. As such, Orr will be responsible for initiating any or all of these actions and will also have the responsibility to contemplate whether the city will file for bankruptcy protection. Orr stated later in March that he will try to persuade bondholders to reduce approximately $8.6 billion in outstanding long term debt, including $6.1 billion of non-GO debt, $963.4 million GO debt and $1.5 billion of borrowings to fund pension liabilities. As a result of Governor Snyder’s

naming an overseer, Standard & Poors raised Detroit’s GO rating of B to stable from negative. Orr faces a very difficult job given years of Detroit’s structural fiscal imbalances, revenues shortfalls, and substantial long term obligations including swap-termination payments and unfunded pension costs.

State Revenue and Employment Improvements

In the fourth quarter of 2012, the Bloomberg Economic Evaluation of States (BEES) Index shows that 44 States (and D.C.) had an improvement in their key economic measures. This was the best improvement in any period since 2006 with states continuing to benefit from growing employment and personal income. The index measures tax collections, home prices, mortgage delinquency, job growth, personal income and performance of local company stocks. There were only four states (New Jersey, Maryland, Wyoming and Maine) that had overall declines in the fourth quarter of 2012 with three states (Arkansas, Nebraska and Delaware) seeing no change. With regards to personal income, every state and the District of Columbia had gains while every state except Connecticut, Nebraska and Delaware saw gains in employment. The BEES index shows state economies strengthened in 2012. There were 29 states that showed improvements in 2012 compared to 17 in 2011.

This positive economic news is leading to an increase in State cash reserves back to the highest levels since 2008. According to the National Conference of State Legislatures, states are projected to increase cash reserves collectively by $3.4 billion to $41.4 billion for FYE2012. As a result, several state governors are looking to replenish or increase their cash reserves with the resulting discussion about potential tax reductions or use of the reserves to spur economic development.

Fitch Reports Hospital Related Sequestration Reductions Manageable

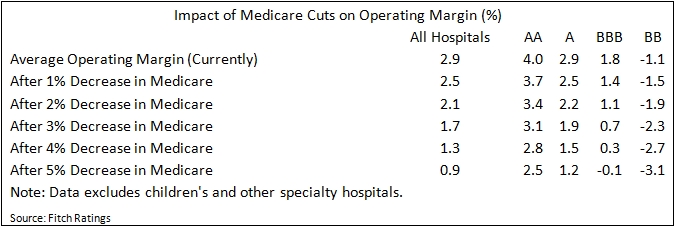

Investors concerned with how legislated sequestraion may hurt hospitals need not worry as much as initially thought. Fitch Ratings, one of the three major rating agencies, released a report analyzing the impact that the 2% sequestration reductions to Medicare may have on hospitals and their ability to offset the reduction with operating efficiencies. Fitch believes that while the reimbursement reductions are a challenge for hospitals, they believe the reductions are manageable due to “…the sectors focus on cost management and resilience throughout the recent recession.” According to Fitch “many hospitals incorporated the sequestration cuts in their 2013 budgets.” The report states that for each percentage point reduction in Medicare reimbursement, operating margins were reduced on average by 30 basis points for AA and A rated hospitals and 40 basis points for BBB and BB rated hospitals. They believe that a 1% reduction in Medicare reimbursement could potentially be offset by a .07% reduction in personnel costs. Given recent strong operating and financial performance in the sector, Fitch believes that any reductions while challenging will remain “manageable.”

TRADING MARKETS

March Underperformance; Municipal Market

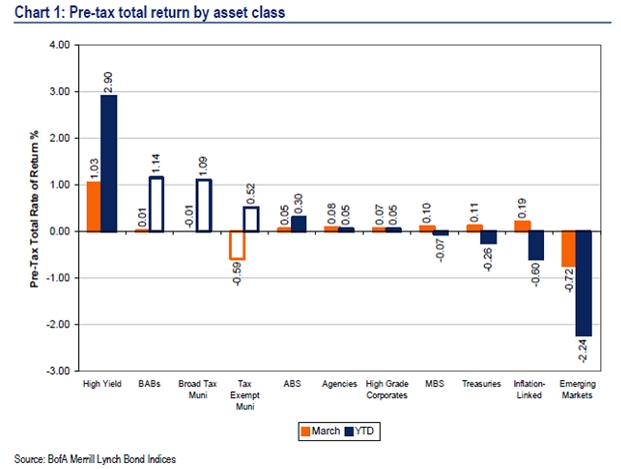

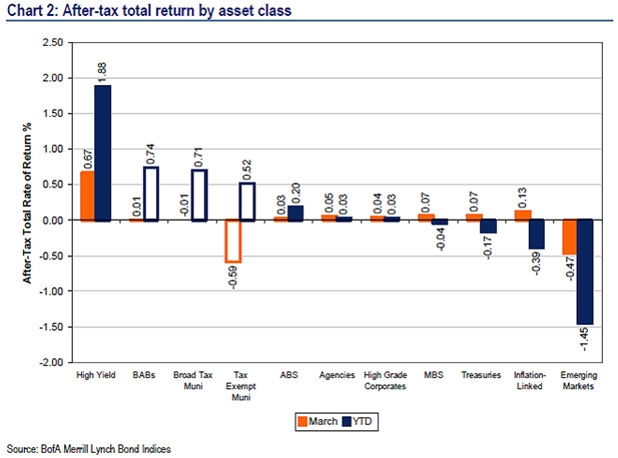

The Bank of America’s Tax-Exempt Muni Index showed that munis were among the worst performing asset class in the high and low grade US bond market during March. Pre-tax total return for munis was down -0.59% for the month yet was up 0.52% YTD. On the other hand, taxable munis broke even for the month, putting them in line with other high grade taxable bond indices. Despite the decline in March, with the exception of high yield and taxable munis, the tax exempt index beat all other major US bond indices in 1Q2013. The reasons for the decline in March include an increase in supply, investors selling off securities to pay taxes, and March typically being the lowest month for bond maturities.

De Minimis?

With the universal expectation that interest rates will rise at some point in the “intermediate future”, the issue of De Minimis comes back into play. As a reminder, the coupon interest income on municipal bonds is often exempt from federal taxation. However, the price appreciation on a bond that is purchased at discount in the secondary market may be taxable. The “de minimis” rule determines if the market discount is taxable as capital gains or ordinary income by creating a level at which an investor’s tax liability may increase. Bonds that go below de minimis boundaries have a higher tax burden and may trade at lower prices in order to compensate buyers for the increase in taxes. In addition, bonds that trade below de minimis often incur penalties in excess of the implied cost from higher taxes. While this de minimis risk is marginal, APA’s defensive strategy is to purchase higher coupon bonds to hedge against this risk to bond holders.

Treasury Yields

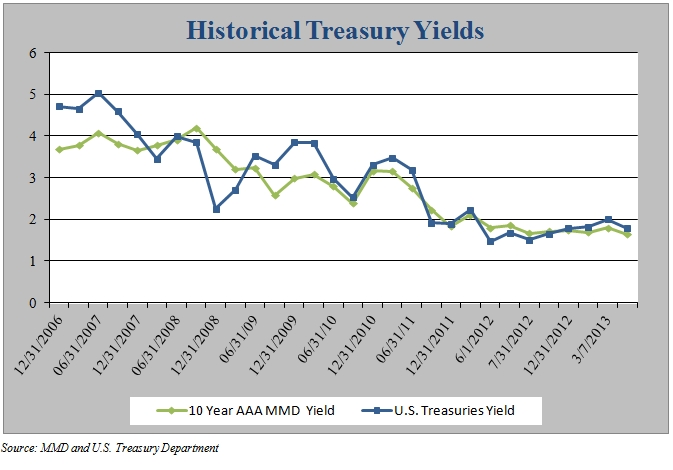

Treasury yields have decreased slightly since last month with 2-year Treasuries at 0.22% on April 5, down from 0.25% on March 7. However, this was a significant increase from 0.10% on December 5, 2012. The benchmark 10-year note yield has also seen recent increases, yet remains near historic lows as evidenced by the 1.78% level on April 5, down from the March 7 yield of 2%. Triple A-rated muni bond “spreads” to comparable Treasures hit one of their highest ratios since 2007 at 121% on June 1, 2012. Current spreads are 92.1% as of April 7, 2013, compared to the historic spread average of 85%. A ratio over 100 indicates that Munis are less expensive relative to comparable Treasuries. The yield on 10 year AAA Munis also showed increases over the past few months. An April 5, 2013 yield of 1.64% was 10 basis points lower than the December 7, 2012 yield of 1.74%.

Source: MMD and U.S. Treasury Department

Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Asset Preservation Advisors, Inc. reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. This is not a recommendation to buy or sell a particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

APA is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill of training. More information about the advisor including its investment strategies and objectives can be obtained by visiting www.assetpreservationadvisors.com. A copy of APA’s disclosure statement (Part 2 of Form ADV) is available without charge upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact APA at 404-261-1333 if you would like to receive this information. APA-13-92

Connect With Us