Categories

Archives

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |

Commentaries

APA August 2013 Market Commentary

By: admin / August 8th, 2013

July proved to be a monumental month in the municipal credit markets. Not only did the city of Detroit finally file for Chapter 9 bankruptcy, but also the city of Chicago was downgraded three notches by Moody’s from a General Obligation rating of Aa3 to a much weaker A3. This month’s commentary focuses on these credit issues and others we are actively watching at APA. We believe fundamental credit analysis has never been more important in the municipal markets.

Detroit’s Chapter 9 Bankruptcy

As we have noted in recent commentaries, Detroit has been on a long, winding road to bankruptcy. Last month’s filing was the largest in the history of the municipal markets with an estimated $18-20 billion in debt to be renegotiated with various stakeholders. It came just a little over one month after the Emergency Manager, Kevyn Orr, released his restructuring proposal. Despite Orr’s claim that it will be a fast process, we believe it will take years to resolve and for the City to get back on solid financial footing. First and foremost, Detroit must prove in a federal bankruptcy court that it has tried in good faith to negotiate with creditors and that it is insolvent and unable to pay its bills. It is expected that creditors (including the 23,500 retirees) will challenge the proposition that the City has tried in earnest to negotiate with them and that it is insolvent.

In Orr’s restructuring proposal, there is more than one controversial or contested idea. First, Orr classifies the City’s General Obligation debt as “unsecured” saying the debt has the same claim to the City’s assets as pension obligations and other post employment benefits (OPEB). Essentially, this pits owners of the City’s General Obligation debt against pensioners. It would be unprecedented in the municipal market if the court allowed the City to treat its General Obligation debt as an unsecured obligation. Moody’s even released a report saying such a ruling could change how it rates general obligation debt. Further, Orr’s plan is currently claiming $3.5 billion in unfunded pension obligations and $5.7 billion in Other Post Employment Benefits (OPEB) such as health care. However, the last actuarial account of the pension fund states the unfunded liability to be $643 million. Orr claims the current assumptions used by the pension fund are not conservative and grossly underestimates the actual liabilities owed to pensioners. Meanwhile, he has yet to disclose exact calculations of how he has come up with the $3.5 billion estimate.

APA has never purchased Detroit General Obligation debt. However, we will be actively watching the proceedings and monitoring the outcome for possible larger ramifications in the municipal market. General Obligation debt has long been considered the gold standard of municipal credits backed by the unlimited pledge of a municipality to raise taxes to pay the obligations back. However, in general at APA, we favor bonds that are secured by a dedicated revenue stream such as essential service (i.e. water/sewer systems) bonds or lease backed obligations with a pledged asset such as property. Over the last few years we have slowly transitioned our credit holdings from a 60/40 split in General Obligation/Revenue bonds to a portfolio comprised of 60% Revenue and 40% General Obligation. While we never expected a General Obligation bond to be classified as “unsecured” by a city, we believe there is value and additional credit security in bonds backed by specific pledged revenues beyond a legal promise to raise additional taxes.

Why Detroit is Unique

After Detroit’s filing, many investors are asking the question “Who is next?” It is important to note that Detroit’s story has elements that are unique unto itself. The city experienced a significant decline in population and tax base, over promised pensions and benefits to retirees for decades, cultivated a political system rife with corruption and mismanagement and had large amounts of debt outstanding while continuing unbalanced fiscal operations and structural deficits. The combination of all of these factors explain why Detroit has filed for Chapter 9 protection.

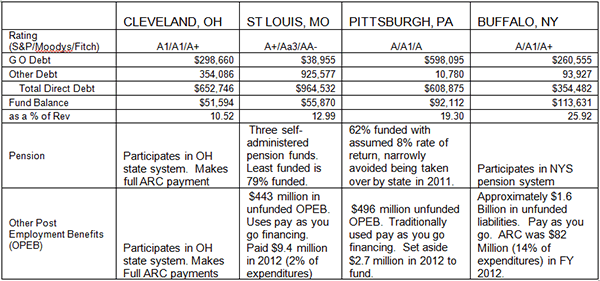

To put it in context we looked at four other cities that have lost up to 60% of their populations since peaking in 1950. While we do not expect any of these cities to be the next Detroit in the near to medium term, we do believe they are names to watch long term as they deal with smaller populations and substantial long-term obligations.

Surprisingly, Cleveland while having the lowest amount of reserves, has the least exposure to unfunded pension and OPEB liabilities due to its participation in the State system and the full funding of their Annual Required Contribution (ARC) payments. This should make their long-term debt manageable. On the other hand, Buffalo, NY has the highest level of reserves and lowest outstanding total debt obligations, but has the highest OPEB expense at 14% of expenditures. It is anticipated this will require larger portions of their budget in future years. Both St. Louis and Pittsburg have sufficient reserves, but manage their own pension systems and have significant unfunded OPEB liabilities. APA has very limited short term general obligation exposure to St. Louis and Buffalo, but no exposure in any portfolios to Cleveland or Pittsburgh. All four of these cities are on our short list of “stressed’ cities that could make headlines in the future and affect the muni market.

Miami charged with fraud by the SEC

Perhaps the biggest risk to municipal credit can be management fraud and political corruption as we saw with Jefferson County, Alabama. Detroit’s former Mayor Kwame Kilpatrick was convicted in March 2013 of corruption charges related to taking bribes and bid rigging. Another city we are watching that has made headlines more than once in the last few years is Miami, Florida which was again charged with fraud by the SEC on its municipal offerings and investor disclosure. The City and its former budget director, Michael Boudreaux, have been under investigation since 2008 and the SEC has concluded that they have “made materially false and misleading statements and omissions” about interfund transfers in three different bond issuances and in two separate audits (FY 07 and 08). The transfers were made to hide deficits in the general fund, making the City appear in better fiscal health than it actually was. The City has responded that they view the lawsuit as immaterial and classified the transfers as routine. However, we consider the City’s weak management and chronic fraud issues as sufficient reason to not own Miami bonds.

Chicago’s multi-notch downgrade

On July 17, Moody’s Investors Service downgraded the Windy City multiple notches from Aa3 to A3 and negative outlook on its general obligation and sales tax bonds. Moody’s cited unfunded pension obligations as the main driver of the downgrade fueled by the State legislature’s inability to pass meaningful pension reform. If the State legislature does not vote to change a requirement (the City participates in State run plans) that the pension funding levels achieve a 90% funding ratio, the City’s pension payments would increase by 150% from approximately $467 million in FY14 to $1.2 billion in FY15. Their current pension system has an unfunded liability of $19.4 billion in FY12 and the City’s ARC was $900 million, which was not fully funded. It is likely that without significant leadership and pension reforms the City would be downgraded even further. However, it would be unlikely for Chicago to need to declare bankruptcy any time soon. The City has a stable, large tax base and tax rates are currently a moderate $1.51 per $100 of equalized value, meaning the City could comfortably raise tax rates and thus raise revenues to cover debt service and pension payments.

Beyond Individual Credits – Private Higher Education May Be Under Pressure

APA believes the Higher Education sector may face some financial pressures in the future. While we generally remain comfortable purchasing highly competitive institutions and larger public universities, we remain selective on private universities with small student enrollments, those with dependency on tuition and student fees, and high tuition relative to their competitors. The issue was highlighted in an article in the Wall Street Journal recently titled “Student Drought Hits Smaller Universities.” The article specifically mentioned Loyola University in New Orleans which is facing a $9.5 million budget gap after enrolling 25% fewer freshman than expected. This decline in enrollment is not specific to Loyola University, as national college enrollment has dropped 2.3% over the last year, according to a National Student Clearinghouse Research Center.

Despite our concerns, we do not expect these major issues to come to fruition in the near future. However, we expect this downward trend in enrollment to continue in smaller, liberal arts colleges, which may strain finances and cause the schools to reduce their cost structures. When reviewing higher education credits, APA reviews factors such as revenue diversity, enrollment trends, and dependency on state appropriations, percentage of applicants accepted, endowments, and age of plant. We believe there is still value in the higher education sector and we will continue to purchase bonds in the higher education sector should they meet APA’s credit criteria.

TRADING MARKETS

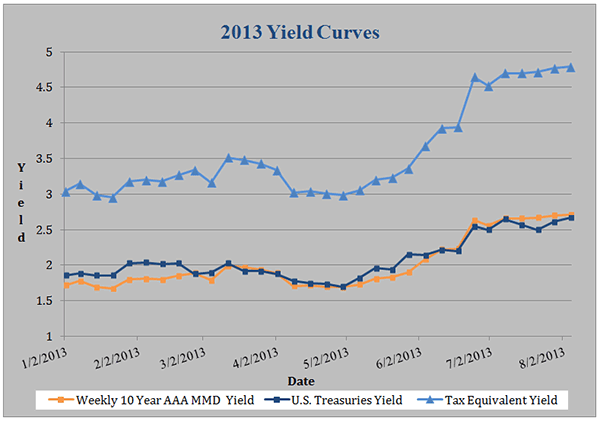

Despite the credit concerns in the market, or perhaps because of, municipals remain relatively cheaper when compared to Treasuries. In addition, the Detroit bankruptcy caused outflows from municipal ETF’s and mutual funds thus driving yields to new highs. The 10 year MMD scale of 2.08% on June 4 increased to 2.71% as of August 5. Treasury rates rallied slightly after a disappointing jobs number announcement on August 2 of 162,000 new jobs added and a decline in the unemployment rate to 7.4% from 7.6% last month. This resulted in 10 year US Treasury bond declines to 2.63% on August 2 from 2.74% on August 1. As of August 5, 10 year Treasury rates have increased to 2.67% and are currently 101.5% of AAA-rated municipals with a taxable equivalent yield of 4.79%.

Source: MMD and U.S. Treasury Department.

Note: The Tax Equivalent Yield only calculated with highest Federal Tax Rate and the 3.8% Surcharge.

CONCLUSIONS

While APA admits that there are stressed credits in the municipal space, there are several thousand more municipal issuers in good financial health that have managed their way through the Great Recession and that we believe remain solid credits now and for the foreseeable future. At APA we are committed to selecting credits of high quality and suitable for our investment strategies. We actively survey the credits we own to attempt to ensure that they maintain their credit quality following purchase. We believe municipals remain one of the most attractive fixed income asset classes providing safe tax-free income while preserving asset value.

Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Asset Preservation Advisors, Inc. reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. This is not a recommendation to buy or sell a particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

APA is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill of training. More information about the advisor including its investment strategies and objectives can be obtained by visiting www.assetpreservationadvisors.com. A copy of APA’s disclosure statement (Part 2 of Form ADV) is available without charge upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact APA at 404-261-1333 if you would like to receive this information. APA-13-224

Connect With Us