Categories

Archives

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |

Commentaries

APA June 2013 Market Commentary

By: admin / June 17th, 2013

Chapter 9 Filing Updates: Good news first, then the not so good news

As Jefferson County, Alabama announced last week that it had reached an agreement to refinance most of its debt and pave the way for an exit from Chapter 9, we saw indications from the city of Detroit that it is seriously contemplating filing the largest bankruptcy in the history of the municipal market. Jeff Co had previously been the largest municipal bankruptcy with $4.2 billion in debt when it filed in November 2011. The present terms of the Jeff Co agreement propose concessions from its largest creditors; notably JP Morgan is giving up approximately 70% of the face value of its debt while smaller creditors are currently being offered 80 cents for every dollar outstanding of sewer debt held.

Meanwhile, Detroit’s seemingly inevitable path to Chapter 9 continues to unfold. The state-appointed Emergency Manager, Kevyn Orr, stated on May 13th that he will determine in the next 60 days whether the City will file for bankruptcy. Currently, Detroit has total outstanding obligations nearing $15 billion in general obligation debt, enterprise fund debt, pension obligation debt, derivative instruments, pensions and other post-employment benefits (OPEB). Orr has stated that the City is “insolvent on a cash-flow basis” and has effectively been running general fund deficits of $100 million on average since 2008.

The fiscal woes of the City stem primarily from a significantly shrinking tax base while the cost of municipal services has remained the same or even increased. Detroit lost 25% of its population from 2000-2010 and its current population is only 701,000 or 38% of what it was when it peaked at 1.85 million in 1950. This translates to approximately 21 people per acre in 1950 to about 8 people per acre now. This has led to large pockets of urban blight with about 15% of all land parcels within the city limits now abandoned and approximately only 60% of city street lights working. The City continues to delay payments for city obligations (such as pension funds) in order to simply avoid running out of cash. While the Emergency Manager has actively been reaching out to creditors and union leaders to work towards finding a solution to avoid Chapter 9, it is unclear how Orr will get everyone on the same page. APA analysts continue to watch this situation closely as the 60 day deadline for the emergency manager to take some sort of action will come up mid-July.

Downgrades and Upgrades: Two different agencies; Two different attitudes

Recently, Municipal Market Advisors (MMA) released a report which surveyed the rating trends by Moody’s and S&P over the last year. According to MMA, S&P has been rating 2.5 upgrades for every 1 downgrade. Conversely, Moody’s had 7 downgrades for every 1 upgrade over the same period. This seems to reflect that there are different attitudes at different agencies. Moody’s continues to state publicly that it is focused on the looming effects of the recession on local governments while S&P is considering updating its local government methodology and raising 1/3 of all outstanding local government ratings one notch.

The downgrades and the upgrades at each rating agency were concentrated in specific states. Year-to-date S&P upgrades were focused in California and Texas, with the agency citing improved finances as the main reason for the higher ratings. Interestingly, downgrades were also focused in California, as well as in Michigan and Illinois. Most often cited were weaker finances and, in the case of California, declines in assessed values coupled with the dissolution of the redevelopment agencies furthered credit pressure. APA remains highly selective in these states and actively monitors its credits held in CA, MI and IL. Approximately 50% of Moody’s 2013 downgrade activity year-to-date has been focused in five states (CA, MN, OH, TX, NY), however, most of the downgrades stem largely from changes to their own housing methodology. APA remains discerning on housing bonds and has a limited exposure to this sector.

Notable Credit Stories Worth Watching

The state of Illinois (rated A3/NEG, A-/NEG) continues to fail to fix its pension problem as its legislature adjourned until spring with neither house taking up the other’s pension reform bill. The State has been placed on watch by all three major rating agencies, with Moody’s recently downgrading the state to A3/NEG due to the General Assembly’s inability to enact meaningful pension reform and the expected burden the obligations will have on the state in the near to medium term. The State’s pension system is approximately 43% funded as of FY 2011 and it is currently the lowest rated state by all three major agencies.

Puerto Rico Garvee (Grant Anticipation Revenue) bonds have long been considered a stronger credit among other Puerto Rico bonds due to their backing by payments from the US Federal Highway Administration Authority (FHWA). However, S&P downgraded the bonds to A and placed them on CreditWatch Negative due to a recent missed debt service payment. The rating agency said this was largely due to administrative deficiencies as the bonds have a fully funded debt service reserve fund. However, interestingly, the administrative error stemmed from a withheld FHWA payment from the US Treasury due to a dispute between the US Army Corps of Engineers and the Puerto Rican government on an entirely unrelated matter. This could be a sign of things to come as the US Treasury was willing to withhold payments despite causing a Puerto Rico bond to default.

Finally, Meredith Whitney, a noted bank analyst, is coming out with a new book discussing the fate of the states. She hypothesizes that people will begin to flock toward the central corridor of the US for low tax rates and stable property values. She continues to back away from her statement of hundreds of billions in defaults in the muni market and yet continues to make claims about seeing trends. We at APA do not have the book on our summer reading list.

TRADING MARKETS

Treasury Yields: What’s the Fed got to do with it?

In addition to our monthly newsletter, APA released a Special Market Report in June addressing recent interest rate fluctuations and APA’s current strategy which can be found on our website: http://162.241.140.166/~asset/apa-municipal-market-insights/.

Perhaps the biggest driver of fluctuating Treasury rates in May and June was the conflicting messages from the Federal Reserve when Chairman Bernanke said the Fed may take a first step toward reducing its bond-buying program at one of its “next few meetings.” Further, he went on to say that he would be reluctant to move pre-maturely or aggressively in reducing the program. However, the subsequent release of minutes from the Fed’s April meeting disclosed that many fed officials were willing to start pulling back the program as early as this month. This information, coupled with a weak jobs report on June 7th, sparked a rise in the 10-year treasury rate to 2.21 as of June 10th, 2013. Bernanke had previously offered guidance that when the economy saw real growth in jobs, the Fed would end the quantitative easing program (QE3). The jobless rate has fallen from 8.1% to 7.6% since launching the program last September. However, the latest jobs report was somewhat tepid with the unemployment rate notching up to 7.6% (from 7.5%) despite the economy adding 175,000 new jobs.

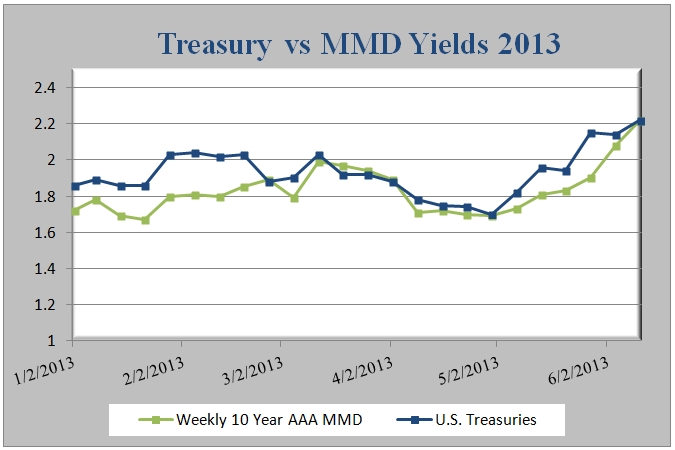

The bond buying program is only one of the easy-money (QE3) policies currently in use at the Fed. Even if the Fed was to start to pull back from the program, it has stated that it would keep short term interest rates near zero until the jobless number hits 6.5% which is widely unexpected by most economists until 2015. While the market may be moving slightly away from historic low rates, we believe it is unlikely that the Fed will allow a great run up in rates in the near term. The chart below illustrates recent 10-year Treasury and Muni Yields.

Source: MMD and U.S. Treasury Department

Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Asset Preservation Advisors, Inc. reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. This is not a recommendation to buy or sell a particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

APA is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill of training. More information about the advisor including its investment strategies and objectives can be obtained by visiting www.assetpreservationadvisors.com. A copy of APA’s disclosure statement (Part 2 of Form ADV) is available without charge upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact APA at 404-261-1333 if you would like to receive this information. APA-13-158

Connect With Us