Categories

Archives

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |

Commentaries

APA September Market Commentary

By: admin / September 10th, 2013

The municipal market ended the month of August with the market holding onto many of the themes of the previous three months. At APA, we continue to find value in municipals and we are taking advantage of the recent sell-off to add what we think are quality credits to client portfolios.

TRADING MARKETS

Redemptions continue to drive the muni market

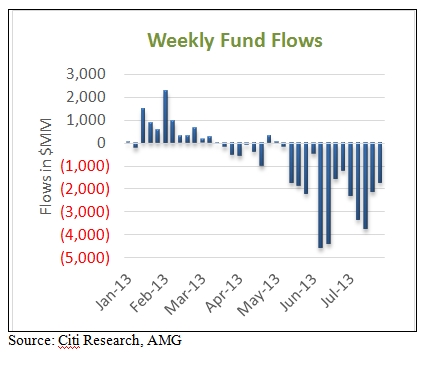

The month of August has traditionally been marked by positive market performance; historically only three Augusts since 1999 have posted losses (and those losses were less than 0.5%). This August seemed poised for a positive performance with very large cash flows coming back into the market from maturing bonds and coupon payments coupled with light issuance. However, more ETF and mutual fund selling overpowered these factors and the market saw weekly average outflows of just over $2 billion. Despite fundamentals pointing to municipals as an extremely cheap and attractive asset class, the forced liquidation of ETFs and mutual funds put pressure on the market, with an abundance of sellers and a lack of buyers. Monthly issuance was down just over $9 billion from August 2012 and the market continues to see pressure on pricing as forced fund selling persists.

Higher rates are the root of the forced selling by large ETFs and mutual funds. As rates climb higher, the market value of the dollar price of bonds declines. This inverse relationship between rates and dollar price is key to understanding the fixed income market. As fixed income funds lose dollar value, the NAV sells at a discount to par. This has incited more retail investor redemptions which further drives down the market value of municipal bond funds. Coupled with negative headlines on Detroit and Puerto Rico, this cycle has further pressured trading in the municipal trading market.

Higher rates are the root of the forced selling by large ETFs and mutual funds. As rates climb higher, the market value of the dollar price of bonds declines. This inverse relationship between rates and dollar price is key to understanding the fixed income market. As fixed income funds lose dollar value, the NAV sells at a discount to par. This has incited more retail investor redemptions which further drives down the market value of municipal bond funds. Coupled with negative headlines on Detroit and Puerto Rico, this cycle has further pressured trading in the municipal trading market.

In light of this sell-off, we believe significant value is to be found in the current market. For the informed investor, we think there are a multitude of opportunities to pick up attractive yields on quality credits. The municipal market is beginning to see crossover buyers (investors who do not normally invest in municipal bonds) as the real rates that munis now provide are enticing buyers from other fixed income investments. As rates increase, new issue volume will likely decline as refundings become less beneficial to issuers. The large amount of sideline cash (cash held by the private sector, as defined by the Federal Reserve, remains in excess of $10 trillion) could create a positive supply/demand imbalance which would fuel secondary market trading activity. We think real rates of return on intermediate and longer dated muni bonds should attract both cross-over buyers and traditional municipal investors as AAA muni bond yields are north of 100% of comparable treasury yields, inflation is still below 2% and the yield curve remains steep.

CREDIT MARKETS

Puerto Rico re-joins the Headlines

The municipal credit markets seemed to be calming down toward the end of August after reeling from Detroit’s move to file for bankruptcy in July. However, on August 26th, Barron’s published a front page story on the state of the Commonwealth of Puerto Rico, setting off another round of municipal credit concerns. Puerto Rico’s general obligation debt gapped out +150 basis points as of September 4th, 2013 following the publication. Puerto Rico has been on the radar for most credit analysts for years now; APA currently does not own any general obligation Puerto Rico bonds. The Commonwealth’s general obligation debt is currently one notch above junk rated Baa3/NEG by Moody’s and BBB-/NEG by S&P and could very likely be downgraded to junk status later this year.

The credit concerns come from a variety of economic and fiscal issues facing Puerto Rico. The Island territory entered into a recession long before the mainland United States; it has been hit harder and continues to struggle to recover. Unemployment is significantly higher than the U.S. at 13.2% and average income levels (indication of poverty levels) remain well below 50% of the U.S. median. Also, population has slowly declined, down by 3% since 2005. Governor Alejandro Garcia Padilla’s newly elected administration has taken steps to push through unpopular reforms. However, there are still substantial shortfalls in the 2013 budget ($2.16 billion operating deficit) and Puerto Rico is unlikely to pass a structurally balanced budget in the near term. Additionally, the Commonwealth’s two pension systems (ERS and TRS) are projected to run out of assets in 2019 and 2022, respectively, and have a combined $33 billion (4x the annual budget) unfunded liability. Nearly 9% of Puerto Rico’s population participates in the pension system, making reforms extremely difficult. In total, the Commonwealth has an estimated $51.9 billion of net tax-supported debt outstanding or approximately $14,000 per capita, significantly higher than any US State.

Puerto Rico is a unique outlier in the municipal credit space. Years of slow growth and counterproductive administrations have plagued the Commonwealth’s economy and financial health. We believe the Commonwealth will very likely be downgraded to junk if significant reforms or improvements are not made in its economy in the near term, further pressuring Puerto Rico’s ability to raise money in the capital markets and possibly leading to a default.

Bankruptcy Updates

Detroit’s next hearing on its eligibility to move forward with its Chapter 9 bankruptcy petition is scheduled for October 23rd. Recently, the City won a small victory over creditors when a judge ruled that it could keep casino revenues (its third largest source of revenue) which had been previously pledged as part of a SWAP agreement. Detroit’s Emergency Manager, Kevyn Orr, testified that the City would run out of cash by the end of the year without the casino monies.

San Bernardino, California has been declared eligible for Chapter 9, almost a year after petitioning the court to enter into bankruptcy. The City can now develop a plan and negotiate with creditors to lead it out of bankruptcy. This exemplifies that Chapter 9 is a slow process that generally takes years for municipalities to go through and subsequently emerge from. APA is watching for the outcome of the negotiations with its pension system CalPERS. CalPERS has been an ardent challenger of the bankruptcy petition, arguing that the City was not eligible. How the pension system is treated in bankruptcy proceedings could set important precedents in future Chapter 9 cases.

The Patient Protection and Affordable Care Act – The Countdown Begins

On March 23, 2010, President Obama signed into law The Patient Protection and Affordable Care Act, or ACA, often referred to as Obama-care. In a little less than a month, one of the first components of the ACA will “go live” with open enrollment for the State Health Insurance Exchanges (HIE) all of which must be fully certified and operational by the end of 2013. As of August 2013, 17 states and the District of Columbia have agreed to operate their own HIEs with 7 having partnerships with the Federal Government and 27 directly operated by the Federal Government. There is a great deal of variation as to how prepared the states and the Federal Government are running these HIEs; some states have well established systems while others are struggling to get ready for the October 1 opening.

The combined expansion of Medicaid and private health insurance is expected to increase insurance coverage for 35 million persons that do not currently have insurance by 2018. The following are some of the key regulatory changes to the health care system under ACA:

- All citizens are now mandated to purchase health insurance or pay a yearly penalty. In 2014, the penalty will be $95 per adult and $47.50 per child (up to $285 per family) or 1% of family income, whichever amount is greater. In 2015, the penalty increases to $325 per adult and $162.50 per child (up to $975 per family) or 2% of family income, whichever is greater. In 2016 and beyond, the penalty increases to $695 a year per adult and $347.50 per child (up to $2,085 per family) or 2.5% of income, whichever amount is greater. The Congressional Budget Office estimates that after redemptions, 6 million citizens will pay the penalty in 2016.

- Expansion of Medicaid to all citizens with income within 138% of the poverty line in those states that have “opted-in” to Medicaid expansion. As of September 2013, 24 states have agreed to expanded Medicaid coverage, 21 have declined to expand and 5 are undecided.

- ACA will reduce Disproportional Share Hospital (DSH) revenues. These are revenues reimbursed by the federal government to states who then distribute payments to hospitals who serve a disproportionate number of low-income patients.

- Children up to age 26 can remain on their parents’ health insurance.

- Insurance companies can no longer reject applicants with pre-existing conditions.

- Health Insurance Exchanges (HIE) created for people to purchase health insurance.

APA believes that as result of this legislation, some states and hospitals may face additional financial and operational pressures in the near term. States may have to spend additional resources to manage the HIE and costs may increase for those states that have opted-in to Medicaid expansion. We generally remain comfortable purchasing states and hospitals with strong underlying credit fundamentals. However, we are highly selective of hospitals with small revenue bases (that may see a greater impact on financial operating margins from ACA), those located in poor urban areas and those that rely heavily on Disproportional Share Hospital revenues.

GEO-POLITICAL AND WORLD EVENTS

The Fed Is the News

As we move closer to the end of 2013, the markets are anxiously awaiting the nomination of the next Federal Reserve Chairman. Of the two front runners, Larry Summers (former Treasury Secretary under the Clinton Administration, Harvard President, and Director of the National Economic Council and Economic Advisor to Obama) and Janet Yellen (former President of the San Francisco Fed, Chairwoman of the Clinton White House Council of Economic Advisers and current Federal Reserve Vice Chairwoman) President Obama appears to favor Mr. Summers. The President has worked closely with Mr. Summers since the beginning of his admisintration and consulted with him frequently during the aftermath of the 2008 financial crisis. However, there are some concerns from the Obama Administration that there would be significant challenges in the Senate during confirmation hearings which could drag on through the spring. Mr. Summers is known for his brash management style and is opposed by many liberal groups for comments made regarding women’s aptitude for math and science during his tenure at Harvard. Additionally, he has publically stated that he is not an advocate of the Fed’s current quantitative easing (QE) policy and would likey be signficantly more hawkish than the current chairman, Ben Bernanke. Conversely, it is widely believed that Janet Yellen would face much smoother confirmation hearings and that as the first Fed Chairwoman would stay the course with QE policy, slowly cutting back bond purchases.

If Mr. Summers is nominated and subsequently confirmed as the next Fed Chairman, interest rates would likely go higher in anticipation of a more abrupt ending of the Fed’s QE policy. The appointment of Ms. Yellen would arguably be less controversial and cause less disruption in the market. The White House has indicated the announcement will likely come in the next few months and that the President had been working toward making an announcment until the crisis in Syria unfolded.

The Debt Ceiling is up for debate again

The Obama administration has indicated that the US is once again approaching its debt ceiling (currently at $16.7 trillion) and Treasury Secretary Jacob J. Lew has asked Congress to raise the debt limit before mid-October to avoid using $50 billion in cash to fund the government. The GOP is insisting on spending cuts before they will approve raising the debt limit with some congressional leaders using the talks as an opportunity to advocate defunding parts of the ACA (aka Obamacare). In 2011, policy debates came to an impass and S&P downgraded the United States’ credit rating from AAA to Aa1 citing the government’s ineffectiveness in matters of fiscal policy. Moody’s maintained the Government’s AAA rating, but assigned a negative outlook (which they revised to stable in July of 2013). This action on the sovereign’s rating affected the credit of several municipalities which had economies closely tied to the US Government; subsequently, many credits were put under review and/or downgraded by both rating agencies. APA has reviewed those credits which are closely linked to the US Government and will be watching the debt ceiling talks closely as the deadline approaches.

Syria’s Civil War

The situation in Syria has weighed heavily on financial markets in recent weeks. As this month’s newsletter was being prepared, the United States seems to be moving toward some sort of military action. However, the scale of the intervention and the make up of the allied parties involved continued to be undetermined. The G-20 Summit of world leaders remains divided on what course of action to take, if any at all. The speculation of the US intervening rattled equity markets in August and gold rallied. While improved economic data led to a recent rise in Treasury 10-year yields, this could be short lived if the United States were to take a more direct role in the Syrian conflict. We believe the conflict is currently the biggest wild card in the fixed income markets in determining where rates may go.

CONCLUSIONS

Desite negative elements impacting the muncipal markets APA is still very positive on municpal credit overall. Most municipalities have managed their finances well and have credit profiles not in the least bit similar to that of Detroit, Puerto Rico or San Bernardino. In July, the Pew Charitble Trust released a report that state revenues were up 4% in 2013 from 2012. In particular, California, which made headlines with budget deficits only a year ago, closed a sizable budget gap and subsequently passed a budget with a projected surplus of $1.1 billion. We have seen states and municipalities trim costs and come up with creative solutions to weather the recession. Many are now poised to rebuild reserves while operating more effeciently. The recent sell-off in municipals has provided APA with what we think is a great opportunity to buy high quality credits at higher yielding rates. We believe that with diligent credit analysis and a market potentially starved for buyers, this could be a great time for investors in the municipal sector.

Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Asset Preservation Advisors, Inc. reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. This is not a recommendation to buy or sell a particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

APA is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill of training. More information about the advisor including its investment strategies and objectives can be obtained by visiting www.assetpreservationadvisors.com. A copy of APA’s disclosure statement (Part 2 of Form ADV) is available without charge upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact APA at 404-261-1333 if you would like to receive this information. APA-13-261

Connect With Us