Categories

Archives

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | 29 |

| 30 | 31 | |||||

Commentaries

APA Special Market Report

By: admin / June 12th, 2013

Interest Rates and Municipal Bonds

Headlines declaring the end of the 30 year bull market for bonds coupled with May’s underperformance in fixed income markets have investors and advisors calling for reassurance on their municipal portfolios. This Special Market Report addresses these concerns and also discusses APA’s outlook and strategy.

In the last month the 10 year treasury rate has increased nearly 50 basis points. This has been fueled by confusing testimony from Fed Chairman Ben Bernanke, the subsequent release of April’s Fed meeting notes and a tepid jobs number. While Bernanke testified that he would cautiously consider reducing the Fed’s bond buying program, the notes from the previous meeting of the Board of Governors indicated several Fed governors were more eager to significantly reduce the program as early as this summer. As the market scrambled to digest this new information, a mediocre May jobs report was released that added 175,000 new jobs to the economy despite the unemployment rate notching up to 7.6% (from 7.5% last month). These events spurred the dramatic increase in rates and left several investors wondering if this was, indeed, the end of the low rate environment.

APA believes the Fed will not allow rates to spike considerably higher in the near term. Considering the current macro environment, we do not believe the Fed is quite ready to back off from their current easy money program. This is due to the lack of significant improvement in unemployment data and job creation, the housing market improving but with home prices still well below pre‐recession levels and inflation (1.1%) remaining well below the Fed’s stated threshold (2.5%) for interest rate tightening. Inevitably, rates will rise from the historic lows of the last few years. However, we believe that any significant increase is still 1‐2 years out on the horizon.

APA continues to maintain a barbell portfolio structure in the current rate environment. Keeping in mind our expectation that rates will remain at current levels, APA continues to utilize and recommend a barbell structure for client portfolios. In such a structure, bonds are held in short term (1‐4 years) and long term maturities (10‐15 years). When rates do rise, the bonds with short maturities allow clients to have a steady flow of maturing positions to re‐allocate to longer dated bonds at higher rates. APA uses callable bonds for the longer dated maturities, which act as a defense against rising rates in addition to adding yield when compared to similar dated bonds trading levels.

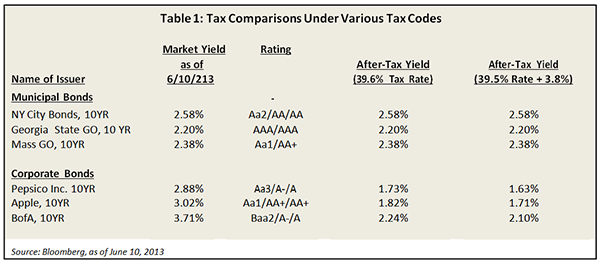

At this time APA believes municipal bonds represent an attractive alternative compared to other fixed income investments. The table below shows current yields on three municipal bonds and three corporate bonds. The taxable bonds appear more attractive at first glance when we look at current market yields. However, when we look at the after‐tax yields utilizing the highest tax bracket of 39.6%, we find the yields on the tax‐free bonds become significantly more attractive when compared to corporate bonds. Additionally, as of January 2013, the highest earning taxpayers pay an additional 3.8% on all investment income, excluding tax free bonds. The additional taxation on the highest earners make municipal bonds even more appealing when compared to corporates for investors looking to pick up yield.

Rising rates will soon offer buying opportunities. APA believes municipals are essential in any high net worth individual’s well diversified portfolio and should be viewed as long term investments with tax‐free income benefits. While long term bonds come under price pressure during a rising rate environment, they continue to provide a stream of tax free interest payments and return par at maturity. APA’s current duration of 4‐5 years enables us to take advantage of a rising rate environment by re‐investing at higher rates as bonds mature.

Patience, experience and pricing opportunities bode well for APA and its client portfolios in the face of fear and uncertainty. As the gap between taxable Treasuries and tax exempt Munis widens, APA utilizes our experienced and recognized trading desk to find opportunities on the bid side and makes tactical purchases. We advise clients to recognize temporary market dislocations and thus avoid premature selling that could lead to unnecessary losses. With strategic positioning in a barbell structure and tactical decision making on the bid/sell side, we believe our clients’ portfolios will continue to reflect the founder’s goal of “Asset Preservation.”

Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Asset Preservation Advisors, Inc. reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

APA is a registered investment advisor. More information about the advisor including its investment strategies and objectives can be obtained by visiting www.assetpreservationadvisors.com. A copy of APA’s disclosure statement (Part 2 of Form ADV) is available without charge upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact APA at 404‐261‐1333 if you would like to receive this information. APA‐13‐ 157

Connect With Us