Short-Term Tax Exempt Strategy

Objective:

The APA Enhanced Short-Term Tax Exempt Strategy seeks to provide a level of current income, exempt from federal income taxes, while providing liquidity and preserving capital.

Strategy:

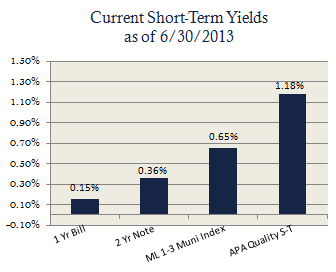

APA’s primary focus is to produce attractive tax-free yields through active management of well-diversified municipal portfolios with an average duration of 0-2 years.

Investment Team:

APA has 8 Investment Professionals which include 4 Portfolio Managers and 4 Analysts focused on this strategy.

Investor Benefits:

The APA Enhanced Short-Term Tax Exempt Strategy is an alternative approach for money market investors who seek enhanced returns, capital preservation, and a high level of liquidity.

Potential benefits of this strategy include:

Potential benefits of this strategy include:

- May provide incremental yield for investors with excess cash

- Tailor portfolios to meet the client’s specific liquidity needs and tax objectives

- Prudently manage risk by diversifying across a number of high quality municipal issuers

Philosophy

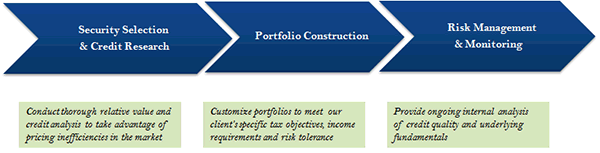

- APA’s active management and effective trade execution allow us to attempt to capitalize on inefficiencies in the municipal market and add value for our clients

- We construct our portfolios with an emphasis on high quality investment grade municipal securities while providing a high level of liquidity

Objectives

- Preservation of principal consistent with client’s portfolio risk exposure

- Produce returns that exceed the appropriate benchmark while attempting to control overall portfolio volatility

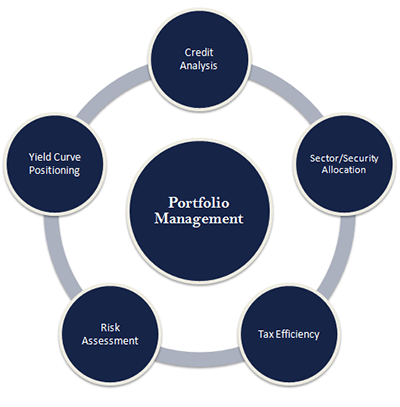

Yield Curve Positioning

- Analyze yield curve to help determine the most favorable risk/reward profile

Credit Analysis

- Monitor credit trends to capture incremental yield

Sector/Security Allocation

- Seek to capitalize on inefficiencies across different sectors, maturities, bond structures and issuers

Tax Efficiency

- Identify and opportunistically harvest losses

Risk Assessment

- Seek to minimize interest rate risk and monitor potential credit issues

Investment Team:

Kenneth R. Woods – Chairman/CEO

Ken Woods established Asset Preservation Advisors, Inc. in 1989 after a long and successful career in the investment industry. Prior to forming APA, he was Vice President and Manager of Bankers Trust Company’s Southeastern Global Market Division located in Atlanta. Mr. Woods holds a B.S. degree in Finance and Economics from Florida State University. In addition he is a member of the FINRA (Formerly NASD) Board of Arbitrators and has been appointed by the Superior Court of Georgia to serve as an arbitrator in fee arbitration. Mr. Woods is also a speaker on topics concerning fixed income and is quoted in many business and financial publications, including The Bond Buyer, Bloomberg Wealth Manager, Barron’s, Money Magazine, and Reuter News. Ken has 40+ years investment experience.

Charles R. Doty – President/COO

Charles Doty has been with APA since 2002 and has been in the municipal bond business for 29 years. He is a graduate of the University of Mississippi and worked for SunTrust Equitable Securities for 16 years, eventually serving as Director of National Institutional Municipal Sales. In 1999 he joined Municipal Trade, an online public finance investment bank, as Chief Operating Officer and President. He is a former Chairman of the Board of Prevent Blindness Georgia and is currently a member of the Advisory Board of Skyland Trail, George West Mental Health Foundation. Mr. Doty is a member of the National Federation of Municipal Analysts and the Southern Municipal Finance Society. Additionally, he has appeared on CNBC in discussion of the global municipal bond market.

Kevin B. Woods – Principal/Portfolio Manager

Kevin Woods has been with APA since 2002. He is a graduate of the University of Mississippi with a Bachelor of Finance degree. Mr. Woods is a Principal of APA and serves as a Portfolio Manager. His responsibilities include research, trading of taxable and tax-exempt securities, portfolio analytics, and client service. He is a member of the National Society of Compliance Professionals (NSCP) and serves as the firm’s Chief Compliance Officer. Mr. Woods is a member of the National Federation of Municipal Analysts, the Southern Municipal Finance Society, and the Atlanta Society of Financial Analysts. Kevin has 10+ years investment experience.

Paul Nolan – Head of Municipal Research

Paul joined Asset Preservation Advisors in June of 2011 and has nearly 14 years of investment industry and related experience. His primary responsibilities include assisting with portfolio analytics and investment research. Prior to joining APA, Mr. Nolan was employed by McDonnell Investment Management, where he was responsible for providing both the municipal and taxable portfolio management teams with fixed income credit and market research, with an emphasis on health care credits. Previously, he was employed by Moody’s Investors Service where he performed municipal credit analysis including general obligation, essential service, and special tax backed securities. He earned a Master of Science in Urban Policy Analysis and Management from the Milano New School University (formerly the New School For Social Research) and also holds a B.A. degree in Political Science from the University of Buffalo. Paul has 14 years investment experience.

Bob M. Farmer – Managing Director

Bob Farmer joined APA in 2008 and has over 30 years investment experience. Mr. Farmer was previously employed by Trusco Capital Management for 28 years where he served as Managing Director of Business Development. He obtained his B.S. degree from Hampden-Sydney College in Economics and a Masters in Commerce and Business Administration from the University of Richmond. He is a member of the Atlanta Society of Financial Analysts and formerly served on the Honorary Board of Directors for Special Olympics of Georgia. Bob has 30+ years investment experience.

Carlton Forrester – Managing Director

Carlton Forrester joined APA in August 2012 and has over 12 years of institutional investment experience. Mr. Forrester’s focus will be on new business development as well as investor relations. Carlton attended the Georgia Institute of Technology, where he graduated with a Bachelors Degree in Business Management. While at Georgia Tech, he was a four year letter winner on the golf team and was a two time All American. Prior to joining APA, he was the Head of Business Development for Perimeter Capital’s hedge fund strategy, Concourse Capital Partners, LP. Carlton also was employed at Credit Suisse First Boston in their Private Client Group, and on the Institutional Sales Teams at Harbert Management Corporation and at HRJ Capital.

Mark Bedner – Managing Director

Mark Bedner joined Asset Preservation Advisors in 2010 following an extensive banking career beginning with Citicorp’s International Banking Group in the Middle East/Africa Division and ending with his retirement as Chairman and CEO of The Merchant Bank of Atlanta following its sale to a BankAmerica predecessor bank. Following his retirement from banking, Mr. Bedner served as an investment professional with Morgan Stanley and Synovus Wealth Management and served as Chairman of the Glynn County Georgia Board of Commissioners. He currently serves as Trustee of the Southeast Georgia Health Systems. He holds B.S. and M.S. degrees from the University of Kansas as well as a graduate degree from the Fletcher School at Tufts and Harvard Universities. Mark has 30+ years investment experience.

Trisha Broussard – Portfolio Manager

Trisha Broussard joined Asset Preservation Advisors in January of 2006. She is a graduate of the University of Southwest Louisiana. Trisha began her career in the Atlanta Municipal Bond Department at Dean Witter, and has been involved in the municipal bond market since 1987. Prior to joining Asset Preservation Advisors, Trisha worked at Morgan Stanley. She was Vice President in the Municipal Bond Department responsible for Southeast trading. She was also Senior Vice President of Municipal Trading at Sterne Agee & Leach. She currently focuses on fixed income trading and client servicing. Trisha has 20+ years investment experience.

Amanda Richter – Senior Municipal Analyst

Amanda joined Asset Preservation Advisors in May of 2013 with 10 years of investment industry experience. Her primary responsibilities include providing analysis on municipal holdings and other municipal research. Prior to APA, Ms. Richter was a Vice President at Deutsche Bank where she provided municipal bond research for the Private Wealth Management sales force and trading desk. Previously, she was employed by Moody’s Investor Service where she performed municipal credit analysis on general obligation, essential service and special tax backed securities. She earned a Master’s of Public Administration with an emphasis in Public Finance from the NYU Wagner School of Public Service and holds a Bachelor’s of Business Administration in Finance from the University of Portland (Portland, OR). Ms. Richter is a former United States Peace Corps Volunteer serving in Uzbekistan from 2000-2001.

Kyle Gerberding – Municipal Trader

Kyle Gerberding joined Asset Preservation Advisors in 2008. He is responsible for trading the 1 to 5 year part of the curve. He also provides assistance in all back office trade allocation and clearing. Kyle is a graduate of the University of Florida with a degree in Business and Sports Management. He is a member of the National Federation of Municipal Analysts.

Matthew Riggle – Municipal Analyst

Matthew Riggle joined Asset Preservation Advisors in 2006. Matt is involved in analyzing credits of municipal securities. In addition, he is responsible for maintaining our client reporting and accounting systems. He is a Cum Laude Graduate of the University of Florida where he received his degree in Business. He has over 7 years of financial services experience.

Kristen Eimer – Municipal Analyst

Kristen Eimer joined Asset Preservation Advisors in 2008. Her primary responsibilities include assisting with portfolio analytics and investment research. She is also involved in developing custom portfolio strategies for our clients as well as contributing to the monthly commentaries for our company. Kristen graduated from UCLA in 2008. Kristen holds the series 65 license and is a Registered Investment Advisor Representative.

Whitney Imeraj – Associate

Whitney Imeraj joined Asset Preservation Advisors in 2009. She is responsible for client services and works closely with the Investment Management Team and Research Team. Whitney produces the marketing material for APA. She began her career as an Investment Assistant at Homrich Berg. Whitney graduated from the University of Georgia in 2006 with a degree in Spanish. She is also a graduate of the University of Georgia’s Terry College of Business with a Master of Business Administration. Whitney has 5 years of investment experience.

Disclosures:

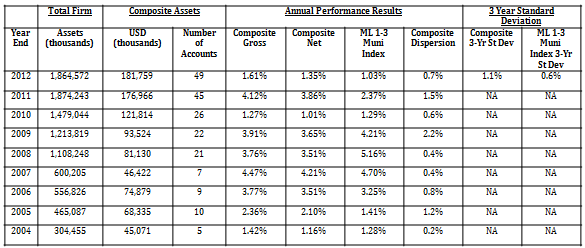

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The performance and portfolio characteristics shown relate to the APA Enhanced Short-Term Tax-Exempt Composite (the “Composite”).

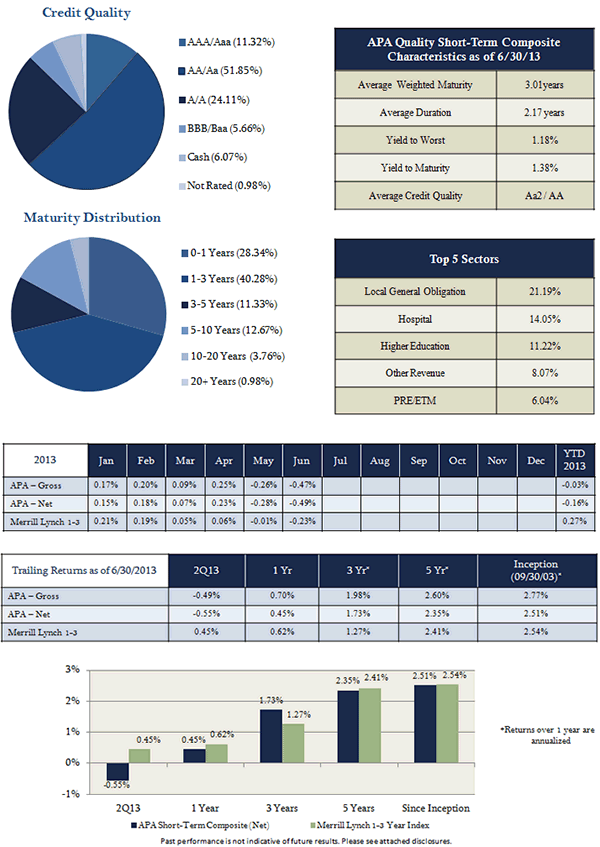

Composite Description: Asset Preservation Advisors (“APA”) uses a fixed income strategy that purchases high quality short-term municipal bonds. The investment objective of the APA Enhanced Short-Term Tax-Exempt Composite is total return, through income, which is exempt from federal income taxes, while providing liquidity and preservation of principal. Securities selected for these portfolios are typically investment grade issues with an average duration of 0-3.5 years. A small allocation of the portfolio may include lower credit quality issues due to certain credit spread and default risk considerations.

Not every client’s account will have these exact characteristics. The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. APA reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

APA is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor including its investment strategies and objectives can be obtained by visiting www.assetpreservationadvisors.com. A list of composite descriptions is available upon request.

The Composite contains fully discretionary, fee paying accounts with a minimum asset level of $1MM. For comparison purposes, the Composite is measured against the BofA Merrill Lynch Municipals 1-3-Year Index. This index tracks the performance of tax-exempt investment grade debt publicly issues by US states and territories, and their political subdivisions, in the US domestic market. Qualifying securities must have at least 1 year and less than 3 years remaining term to final maturity, a fixed coupon schedule and an investment grade rating (based on average of Moody’s, S&P and Fitch). The volatility (beta) of the portfolio may be greater than that of the indices. It is not possible to invest in this index. Leverage, derivatives or short positions are not used in this Composite. The annual composite dispersion is an asset-weighted standard deviation calculated for the accounts in the composite for the entire year. For this Composite, APA defines a significant cash flow as greater than or equal to 30% of an account’s market value at the beginning of the measurement period. Accounts removed from the composite due to significant cash flows will be excluded for a grace period of one month. Additional information is available regarding the treatment of significant cash flows upon request. The U.S. Dollar is used to express performance. The APA Enhanced Short-Term Tax-Exempt Composite was created December 31, 2009.

Asset Preservation Advisors, Inc. claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Asset Preservation Advisors, Inc. has been independently verified for the periods January 1, 2004 through December 31, 2012. A copy of the verification report is available upon request. Verification assesses whether (1) the firm has complied with all the composite construction requirements of the GIPS standards on a firm-wide basis and (2) the firm’s policies and procedures are designed to calculate and present performance in compliance with the GIPS standards. Verification does not ensure the accuracy of any specific composite presentation.

The three-year annualized standard deviation measures the variability of the composite and the benchmark returns over the preceding 36-month period. The standard deviation is not presented for 2002 through 2010 because monthly composite and benchmark returns were not available and is not required for periods prior to 2011.

A firm is required to present the three-year annualized ex-post standard deviation of the composite and the benchmark for annual periods ending after 2010, monthly returns must be used in this calculation. Prior to January 2010 composite returns were calculated quarterly; therefore monthly returns for the 36-month period ending December 31, 2011 are not available, and the standard deviation of the composite and benchmark are not presented.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by investment advisory fees and other expenses that may be incurred in the management of the account. For example, a 0.50% annual fee deducted quarterly (.125%) from an account with a ten year annualized growth rate of 5% will produce a net result of 4.4%. Actual performance results will vary from this example. Net returns are calculated using actual management fees. The Firm’s policies for valuing portfolios, calculating performance, and preparing compliant presentations are available upon request.

The fee schedule for APA’s investment advisory services for separately managed accounts in the APA Enhanced Short-Term Tax-Exempt Composite is .25% on net assets under management. Actual investment advisory fees incurred by clients may vary. A complete description of APA’s fee schedule can be found in Part 2 of its FORM-ADV which is available at www.assetpreservationadvisors.com or by calling (404) 261-1333. APA-13-198

Connect With Us